You aren’t going to stay in business long if you aren’t making any money.

As a business owner, you’ve got to have a firm grip on how much it costs to produce each one of your items, how much money you’re making from customers for each item you produce, and how you’ll be able to use those numbers to maximize your company’s profits.

That’s where knowing your marginal revenue is really going to come in handy.

This guide explains marginal revenue, the formula for calculating marginal revenue, and the difference between marginal revenue and marginal cost. We’re going to cover key topics like:

- What is marginal revenue and why does it vary?

- How to calculate marginal revenue

- Marginal revenue vs. marginal cost

- Comparing marginal revenue to marginal cost

- Marginal revenue vs. marginal benefit

- Marginal revenue vs. average revenue

What is marginal revenue?

Before we break down how to calculate marginal revenue, let’s pump the brakes and talk about what marginal revenue means.

Simply put, marginal revenue is the amount of money a company gets every time it sells one more unit of a product or a service. In other words, your company’s marginal revenue is the amount of money that you end up getting from your most recent sale.

For example, let’s say you run a tailor-made clothing company. At the end of a day on Monday, you sell two suits at $400 apiece. That means your shop’s total revenue is $800, and your marginal revenue is going to be $400 per suit.

But let’s say the next morning you sold a new suit for $500. Then half an hour later, you sell another suit for $300. That means your marginal revenue is $300 — even though your total revenue is the same as it was the day before.

OK, so that’s what marginal revenue is, but why is marginal revenue important?

Marginal revenue is important for companies because it essentially represents extra money that a business can use toward expenses. After all expenses are paid, that revenue goes on to build a company’s retained earnings.

Retained earnings is a term that businesses use to describe the part of their company profits that don’t go to stockholders as a dividend payout. Instead, the business will reinvest that money back into company operations.

Why does marginal revenue vary?

Generally speaking, marginal revenue is going to stay about the same for most companies and most products, most of the time. That’s because businesses generally sell the same goods or services at the same prices, and only change their prices occasionally.

But the law of diminishing returns means that your marginal revenue will eventually decrease along with each extra unit of a product you sell.

Imagine you’re selling shoes for $100 a pair. The theory states that eventually everyone who wants a pair of shoes for $100 will have bought some. So, to sell more shoes — to increase the level of demand — you’ll need to reduce the price.

If you drop it to $90 a pair, suddenly your level of demand has gone up … but your marginal revenue has gone down.

The law of diminishing returns, also known as the law of diminishing margin, is an old economic theory. Obviously, there are exceptions to this rule, but in general, it plays out.

Knowing your marginal revenue and your marginal cost (which also typically follows the law of diminishing returns) can help you calculate the price and volume of demand that will make you the most profitable.

Generally speaking, if you run a company that’s selling enough of its products to meet customer demand, you’ll probably need to lower your prices to keep demand up. For example, you might start to offer bulk discounts or special offers to entice customers to keep on buying.

This goes back to marginal revenue and its relationship with marginal benefit — which is the added value each additional unit of your product brings to a customer. But we’ll talk about marginal cost and marginal benefit some more in just a minute.

First, let’s talk about how to calculate marginal revenue.

What is the formula for calculating marginal revenue?

We’ve already covered why marginal revenue is important. If you want to figure out your company’s marginal revenue, the formula for calculating it is actually pretty straightforward.

You can figure out your marginal revenue by dividing your company’s change in total revenue by the change in the number of units you’ve sold.

But let’s break that down a little bit further.

First, there’s your change in revenue. If you want to calculate a company’s change in revenue, all you’ve got to do is take your revenue before you sold your last unit, then subtract that number from the total revenue you had after.

The number you’ve got left is your change in revenue. Divide it by the number of units you’ve sold, and you’ve got your marginal revenue.

Need an example? Let’s say you run a sawmill.

Last week, you were selling 10 oak fence posts per day. Now, you’re selling 15 fence posts. Last week, your total revenue was $200, versus $280 this week.

By putting those values into the marginal revenue formula, you’d record a change in revenue of $80. Your change in quantity is 5 pieces. So you’d divide $80 by 5 — which is $16. Your sawmill’s marginal revenue for fence posts is $16.

Why is it important to calculate marginal revenue?

Simply put, by working out your marginal revenue, it’ll be a whole lot easier to figure out how you can maximize your profits. This is particularly important if you have a different price for different volumes.

So going back to our sawmill example, you’ll probably have a range of different products — not just fence posts. You might also sell mulch, beams, and all sorts of other wood products. Each of those products will have its own marginal revenue.

This will tell you which of your products are performing the best and which you might want to tinker with.

How to make marginal revenue increase

One of the top questions managers have about marginal revenue is how can you make it go up?

Marginal revenue increases whenever the money you get from making one extra unit of a product is more than the amount you made from the piece before.

When your company can increase its marginal revenue, it should serve as a sign to investors or shareholders that your business isn’t producing enough in relation to demand.

This then tells you that you can capitalize on profit opportunities by expanding the production level you’re operating at.

For example, let’s say you’ve got a business making Teddy bears. It costs you $500 in materials to make 100 Teddy bears — and at this point, your Teddy bears are selling for $15 a piece. That means your profit for each Teddy bear is $10.

But let’s say that the 101st Teddy bear that you sell goes for $17 — even though it still costs $5 to make. This increases your marginal revenue from $15 to $17.

You’ve just got to be careful when it comes to increasing prices. After all, if you hike your prices too much, customers may decide to take their business elsewhere.

To make sure you’re getting your marginal revenue just right, you’ve also got to consider marginal cost, marginal profit, and marginal benefit.

These metrics often get confused, but they’re all unique, and each one tells you something different about your business and the goods or services you produce.

Marginal revenue vs. marginal cost

We’ve already briefly mentioned marginal cost, but it’s really important to talk about what marginal cost is and how it relates to marginal revenue.

Marginal cost is often called “the marginal cost of production.” But it all amounts to the same thing.

Simply put, marginal cost is the amount of money you’ve got to spend each time you decide to make one more unit of a product or service that you’re offering.

Marginal cost follows the same law of diminishing returns we discussed earlier.

For example, let’s say you run a bustling shoe factory. At some point, your factory will be operating at the optimum level. That means you’re making shoes as efficiently as you possibly can — and you’re generating the most money you possibly can from each sale.

The law of diminishing returns says that if you tinker with your factory’s production process by hiring more factory workers, your operations would actually be less efficient.

That’s because your shoe production was already at its most economically efficient — so hiring more staff members would simply diminish your returns because you’d have higher costs.

Let’s revisit our sawmill example one last time.

It costs $1,000 to produce 100 fence posts. But if you want to produce 101 fence posts, it costs you $1,010. That means the marginal cost of producing each extra fence post in your sawmill is $10.

Theoretically speaking, most companies will keep producing or selling goods or services until their marginal revenue is the same as (or less than) the marginal cost of producing those items or services. This will make sure those companies can pursue profit maximization.

Once your marginal revenue and marginal cost hit the same number, your profit margin is zero — so you’re not making any money.

How to compare marginal revenue to marginal cost

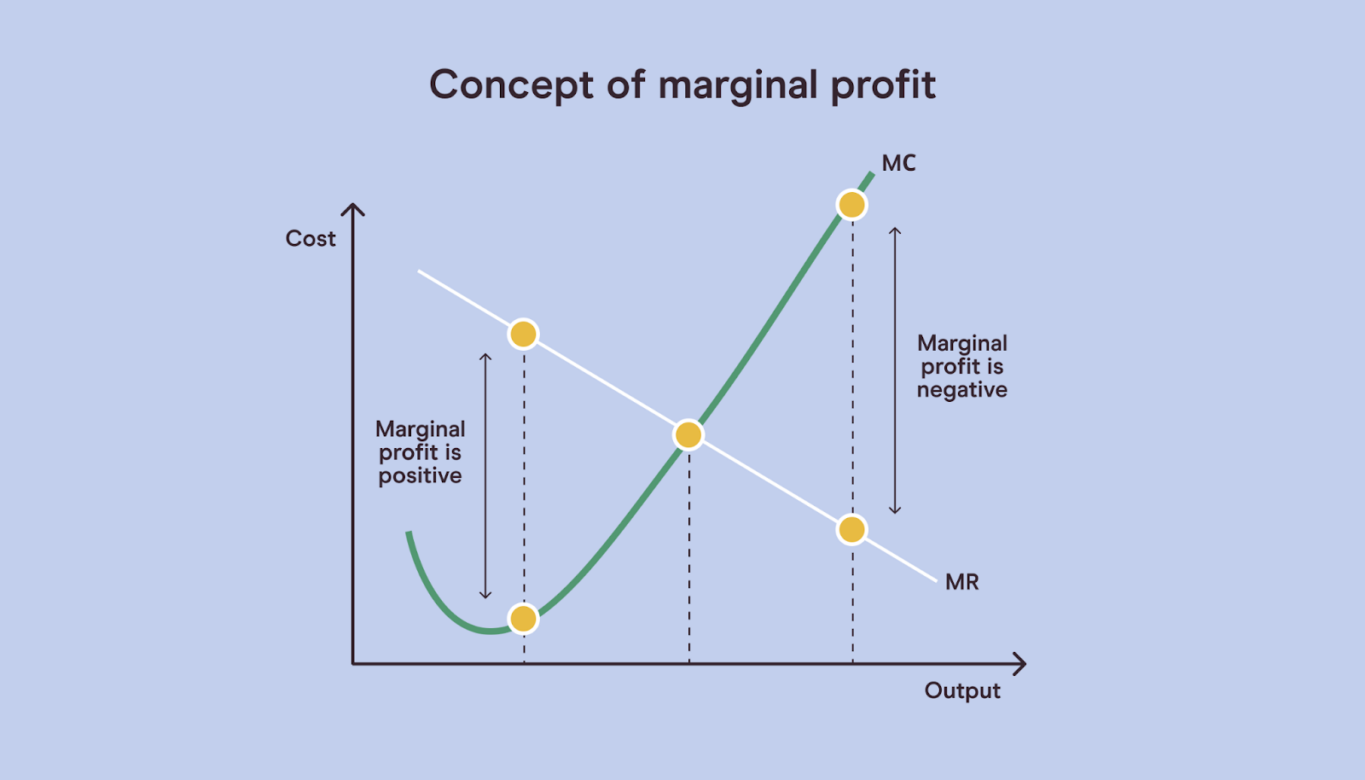

If you want to use marginal analysis to look at your marginal cost and how it relates to your marginal revenue, the easiest way to do that is to plot your company’s production costs and revenues on a basic line graph.

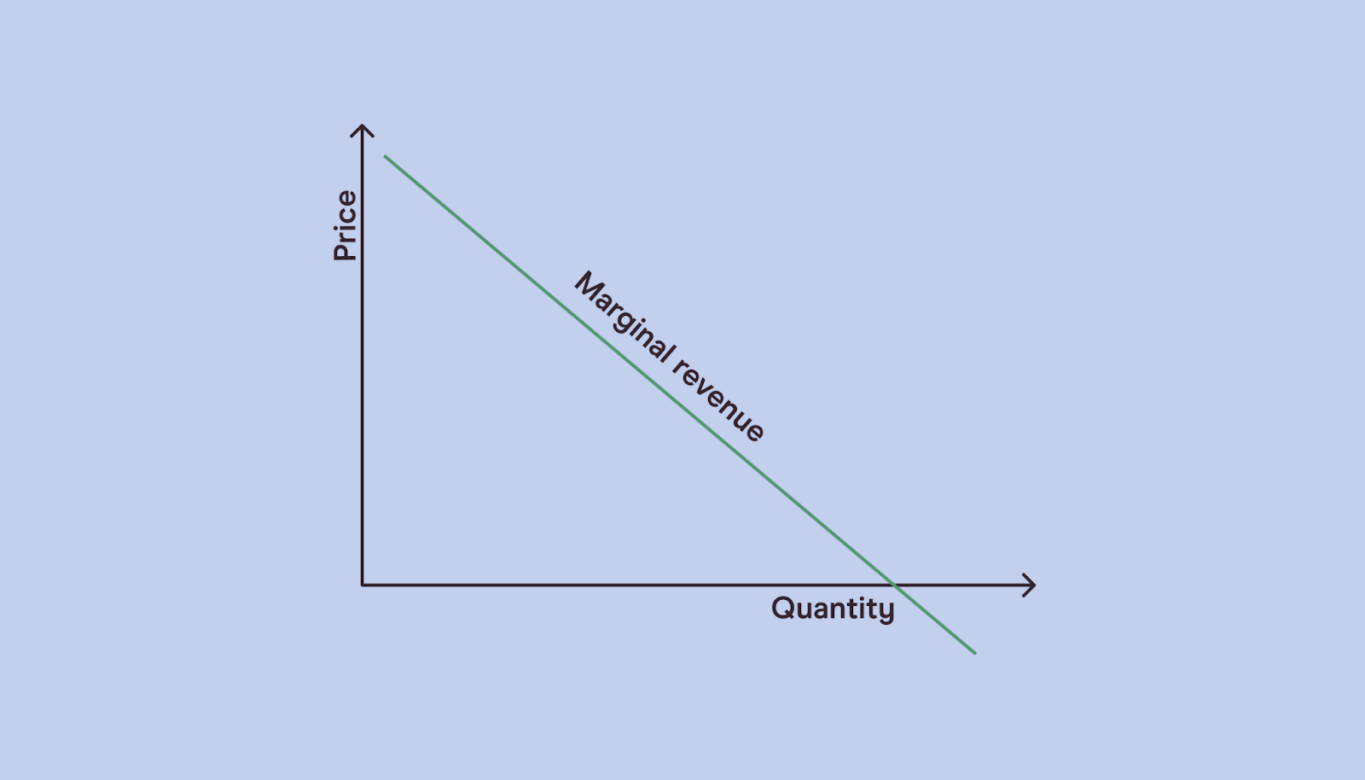

After you’ve plotted all your points, the lines that you’ve got left should take the form of two different curves.

Your marginal cost will be a U-shaped curve. This is because your marginal cost for each additional unit will generally be less than the one before it until you hit the optimum production level we talked about. After that, selling additional incremental units will make your marginal cost start to creep up.

Next, you’ve got your marginal revenue curve. This one is supposed to be sloping downward. That’s because, to sell more units, you generally have to offer lower prices — as in our shoe example.

Where the two lines intersect is often your optimal production and sales level.

Once you’ve started to track your company’s marginal revenue and marginal costs, you’ll be able to start calculating marginal profit.

Marginal profit is your company’s profit when one additional or marginal unit is created and then sold. Determining your marginal profit is super simple.

All you need to do to calculate marginal profit is to take the difference between your company’s marginal cost and its marginal revenue. This is also sometimes referred to as “marginal product,” but it all amounts to the same thing.

Marginal profit analysis is a great way for a business to look at all of its operations to determine where it might like to expand operations — or shut down production entirely.

For example, let’s say that you run a busy bakery. You might find that you’ve got a positive marginal profit selling cinnamon rolls. But you may currently have a negative profit margin selling cupcakes. This might tell you that it would be worthwhile to slow down or stop making cupcakes and funnel those resources into making more cinnamon rolls instead.

Marginal revenue vs. marginal benefit

We’ve already covered metrics like marginal revenue, marginal cost, and marginal profit. But it’s also worth taking a quick look at marginal benefits.

Any time you gain benefits from adding an extra unit’s worth of activity to your business, you’ve got what’s known as a marginal benefit. One of the biggest marginal benefits that a company can experience is when its marginal revenue exceeds its marginal cost to create a marginal profit.

But more often than not, you’ll hear about marginal benefit from the consumer side of things.

From a consumer’s perspective, the marginal benefit is the maximum amount of money that a customer is willing to pay for each extra unit that your company produces.

How to Find Marginal Benefit: Examples

Let’s say that you run a big car factory. Your most popular model is a sedan that goes for $20,000 per car. You’ve got healthy customer demand for that model, and it seems to be priced well.

But after a customer has bought their first sedan, chances are they’re not going to need a second one anytime soon. As a result, buying an additional unit of your product is worth less money to them.

That means they’re willing to pay less for a second car — and the dollar amount that they’re willing to pay is the marginal benefit of your product.

How to Calculate Marginal Benefit

Calculating marginal benefit involves determining the price of a second sale of the product your consumer has already paid for. Since automobiles are rarely purchased in pairs, let’s use a clothing store as the example here.

Your clothing store charges $17 for a graphic t-shirt and your manufacturer charges $6 per shirt and $0.50 for shipping on each one. Currently, your store sells 40 shirts per day at a profit of $10.50 per shirt. Subtracting manufacturing and shipping, means your graphic t-shirts bring in about $420 from this one product category.

However, dead inventory can sink any business, so you want to move other t-shirts that are not selling as well as your top products. To incentivize the consumer, you are going to offer a buy-one-get-one deal at an attractive discount.

To do that, you need to figure out how to calculate the marginal benefit.

You decide to do a buy-one-get-one promotion where the second shirt costs 25% less than the listed price. The second shirt now costs $12.75. When you subtract the $6.50 from that reduced price, your special offer now brings in $6.25 of profit. Now, each BOGO sale generates a combine $16.75 of earnings when the margins of both t-shirts are factored in.

Over the first month of selling shirts with this promotion, your clothing store now moves 80 units of graphic t-shirts per day. Everyone who is buying the one shirt seems to like the new offer. Here, the $6.25 profit from the second shirt becomes your marginal benefit.

To put it plainly, the clothing store could calculate marginal benefit this way:

$10.50 for the full-priced shirt + $6.25 for the second shirt = $16.76 total profit – $10.50 for the full-priced item = $6.25 marginal benefit.

Over time, you should analyze how well your marginal benefit-driven promotion impacts sales. If it is not generating the profits you’re looking for, you may have to adjust your calculations to arrive at a marginal benefit that both makes sense for you and your customers.

Marginal revenue vs. average revenue

Sometimes people confuse marginal revenue with average revenue. But there’s a pretty distinct difference between the two metrics.

We know that marginal revenue is the amount of money you get every time your company sells one additional product. By contrast, your company’s average revenue is the average amount of money a company makes every time it sells a product.

The formula to work out average revenue is to divide your gross income from sales by the total quantity sold. This will tell you the average amount of revenue you’re making per item.

How is this different from marginal revenue?

Marginal revenue isn’t about establishing an average across all of your sales, but it essentially tells you the amount you’ve made on your most recent sale.

Both are useful metrics.

You might want to figure out your average revenue if you’re trying to project a ballpark average as to how much revenue you can expect to bring in for a particular product line you’re about to launch.

Conclusion

At the end of the day, marginal revenue is an incredibly useful metric for companies of all shapes and sizes. It tells you how much your revenue goes up whenever you sell an additional product or service. Fortunately, calculating your marginal revenue is pretty simple.

All you’ve got to do to find your marginal revenue is to subtract your revenue before the last unit you sold from the total revenue after the last item that you’ve sold. The number that you’ve got left is your marginal revenue.

After you’ve figured out your marginal revenue, you can then start to look at your marginal profit. This will help you analyze where your business is doing well and where it needs some improvement.

Are you ready to learn more about how to calculate marginal revenue? Check out our range of masterclasses to develop tools you can use tomorrow at work. Pareto Labs offers engaging on demand courses in business fundamentals. Built to help you elevate your game at work, our courses distill complex business topics — like how to read financial statements, how to manage people, or even how to value a business — into digestible lessons. No business background required. Our library of 200+ lessons will teach you exactly what you need to know to use it at work tomorrow. Sign up for a free trial today to start watching.