In some industries, companies will ask for payment in advance before they complete their services or provide a product.

The money that you receive from your customer before you’ve provided a product is called unearned revenue.

Unearned revenue is great in many ways. For example, getting paid upfront means you don’t need to chase up customers for overdue invoices or wonder when you’re going to receive the money.

But it can also make accounting for revenue more difficult.

This article will explain what unearned revenue is, common items that lead to unearned revenue for a company, and how to do accounting entries for it.

What is unearned revenue?

Unearned revenue is recorded whenever a customer pays for a service or product before they receive it. Your business receives the money upfront, and then does the work to earn it at a later date.

Sometimes it’s also called deferred revenue, prepayment, or advance payments.

For large projects, it may take weeks or months between when a customer prepays and when the final goods are delivered. So there needs to be a way to account for this money in the meantime.

Why companies record unearned revenue

Companies that use the accrual method of accounting are required to record unearned revenue. This is a particularly important requirement for any large publicly-traded company.

The accounting principle of revenue recognition states that revenue needs to be recognized when it’s earned, not necessarily when payment is collected.

Despite the name, unearned revenue isn’t a type of revenue that shows up on your income statement. Instead, it goes on the balance sheet as a liability (something you owe) to offset the cash received when a business is paid in advance.

At some point, the business will either need to provide the goods or services that were ordered, or give cash back to the customer if they aren’t able to fulfill the order. That’s why it’s a liability — until you’ve done the work, the money isn’t truly yours yet.

Once a company delivers its final product to the customer, only then does unearned revenue get reversed off the books and recognized as revenue on your profit and loss statement.

Is unearned income the same as unearned revenue?

Although they sound similar, unearned income and unearned revenue aren’t the same thing. It’s important to distinguish between them, since they’re treated very differently for accounting purposes.

Unearned revenue is any money received by a company for goods or services that haven’t been provided yet. It’s a buyer prepaying for something that will be supplied at some point in the future.

Unearned income is income that a company receives from investments or other sources that aren’t related to its main business activities. It can include things like interest earned on money in the company’s bank account.

This is in contrast to earned income, which is income generated by regular business activities, employment, or work.

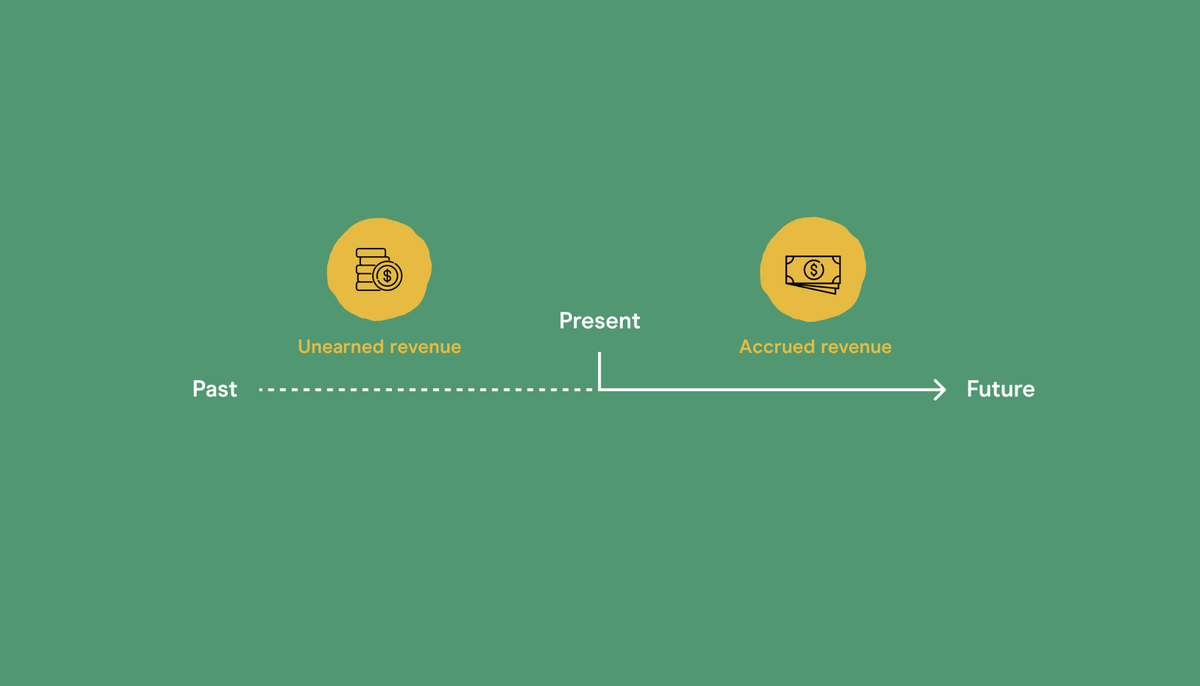

What is the difference between deferred revenue, unearned revenue, and accrued revenue?

Unearned revenue and deferred revenue are synonymous. They’re referring to the same thing, so you can use these two terms interchangeably.

However, these two terms are different from accrued revenue. The difference is when the customer pays.

For deferred or unearned revenue, the customer pays in advance for goods or services that are provided later.

Accrued revenue is the opposite. The goods or services are provided upfront, and the customer pays for them later. Usually based upon pre-agreed credit terms.

You won’t see accrued revenue on the books for very long in most businesses. That’s because accrued revenue only exists when money has been earned, but not yet invoiced.

Once a business issues an invoice, the accrued revenue becomes accounts receivable on the balance sheet instead.

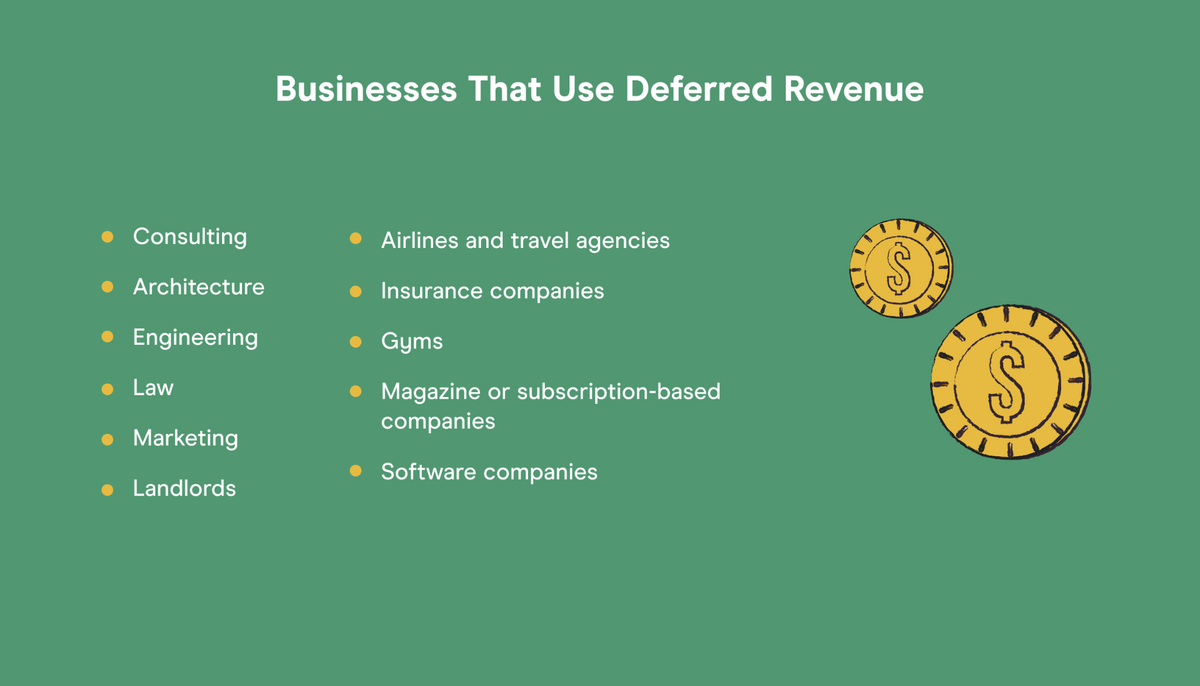

What types of businesses use deferred revenue?

A wide range of different industries make use of deferred or unearned revenue. Below are some key examples.

Insurance companies

It’s common for insurers to take payment in advance for all kinds of insurance products — such as home, auto, and life insurance.

Policyholders may pay in advance for a year at a time. Many insurance companies offer discounted rates to encourage this type of prepayment.

Subscription services

This could be any service that requires payment upfront for an ongoing product or service. Typically, the customer is billed at the beginning of the month.

Subscription services can include things like:

- Magazines

- Subscription boxes

- Gym memberships

- Meal delivery

- Software licenses or SaaS subscriptions

- Website hosting

- Phone plans

Landlords

Property management companies, or individuals who own real estate, may take advance rent payments.

In many places, it’s common for tenants to provide first and last month’s rent when signing a lease.

Some landlords may also offer a better rate for prepaying part or all of a lease term in advance. Especially for commercial real estate.

Travel and hospitality

This includes things like:

- Airline tickets

- Event catering

- Hotel rooms

- Event or concert halls

- Travel agency packages

Professional services

Generally, it’s more common for companies who provide services to get paid in advance compared to those who provide a physical product.

Some service industries where unearned revenue is common include:

- Law

- Marketing

- Consulting

- Engineering

- Architecture

- Contract services (landscaping)

Example case of unearned revenue

Understanding unearned revenue in theory is one thing. But let’s look at a practical example to help solidify the concept.

Magazine Inc provides a monthly magazine subscription.

On July 1, Magazine Inc received a $60 payment for a one-year subscription from a new customer.

Since the magazine issues will be delivered equally over an entire year, the company has to take the revenue in monthly amounts of $5 ($60 spread over 12 months).

On July 1, Magazine Inc would record $0 in revenue on the income statement, since none of the money has been earned yet. Cash on the balance sheet would increase by $60, and a liability called unearned revenue would be created for $60 to offset it.

On July 31, the company sent its first magazine to the customer. $5 would be recorded as revenue on the income statement, and the unearned revenue liability would be reduced by $5 to offset it. Cash remains unaffected.

This cycle of recognizing $5 at a time will repeat every month as Magazine Inc. issues monthly magazines. At the end of month 12, the $60 in revenue will be fully recognized and unearned revenue will be $0.

How unearned revenue works

Unearned revenue (aka deferred revenue) is a liability that gets created on the balance sheet when your company receives payment in advance. You can think of it like a promise or IOU to provide a product or service at a later date.

Since the customer may have the option to cancel their order, or the product or service may not get delivered for other reasons, the payment is considered a liability for the company receiving it. In any case where the customer doesn’t receive what they ordered, then the company would need to repay the customer.

For most businesses where prepayment terms are 12 months or less, unearned revenue is treated as a current liability on the balance sheet.

But if you have a customer prepaying for something that will be delivered over several years, the portion that will be provided after the first 12 months should be accounted for separately as a long-term liability.

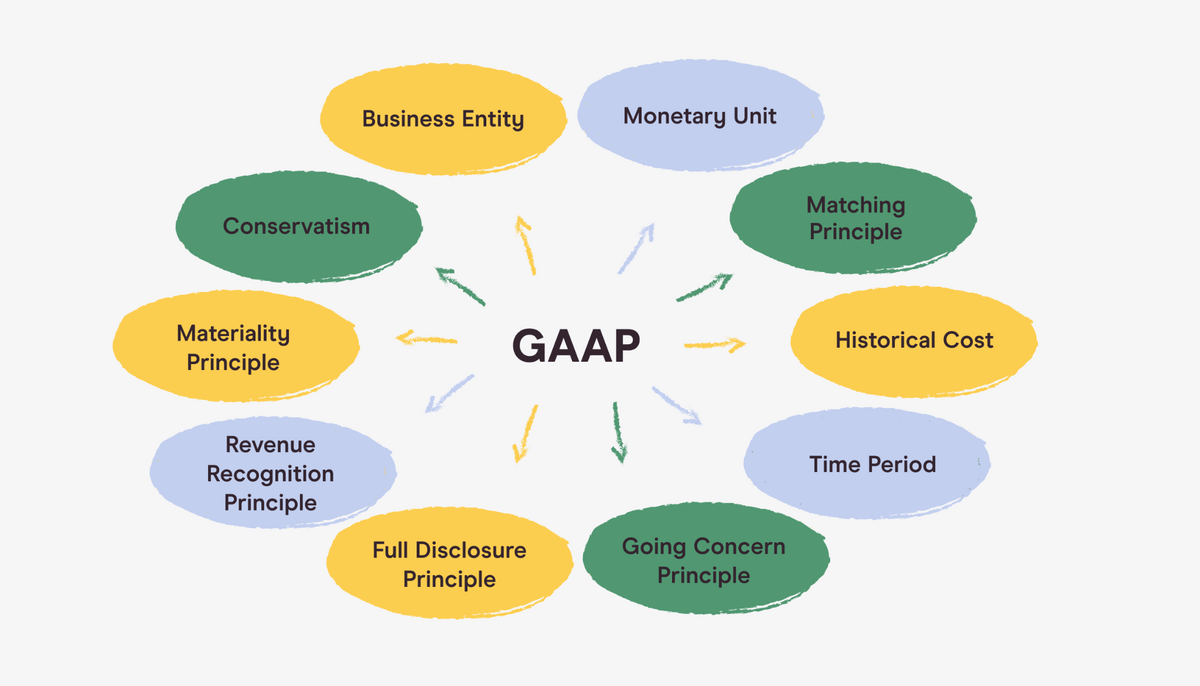

Unearned revenue and the conservatism principle

Aside from the revenue recognition principle, we also need to keep the accounting principle of conservatism in mind when dealing with unearned revenue.

The conservatism principle says that no profit should be recorded by a company until it’s certain to occur. Basically, we want to be cautious about reporting items on financial statements. We only want to recognize revenue once specific tasks have been completed, which give us full claim to the money.

In our previous example, this would be whenever the magazine company actually sends out the next issue of its magazine.

Trying to convert unearned revenue into earned revenue too quickly, or not using a deferred revenue account at all, can be classified as aggressive accounting. If revenue gets posted to the income statement too early, it can overstate actual sales revenue.

When is unearned revenue recognized?

Unearned revenue is recognized and converted into earned revenue as products and services get delivered to the customer.

If the product or service is delivered incrementally instead of all at once, then revenue should be recognized equal to the amount of goods being exchanged.

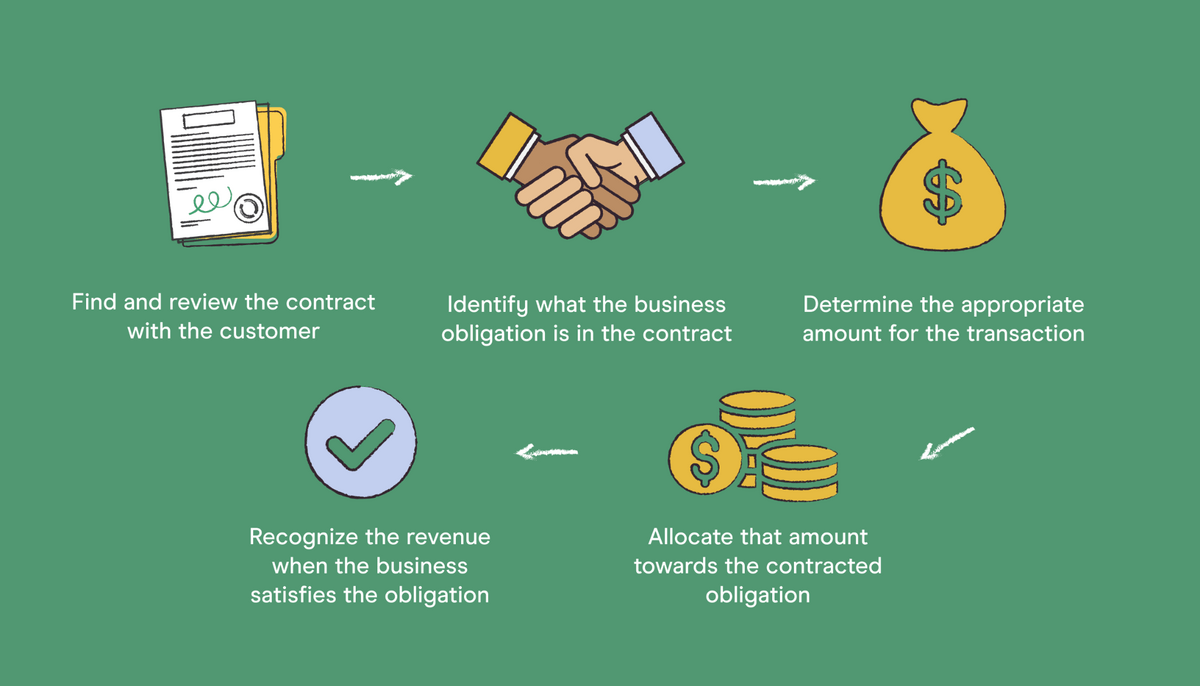

You can follow these three steps to make sure that you’re accurately recognizing unearned revenue at the correct time:

1. Review the contract and identify what your business obligation is: What are you required to provide in exchange for the advance payment that you’ve received?

2. Decide on the appropriate amount of revenue to recognize for the transaction as work is completed: Usually, this will be an allocation based on the percent of goods or services delivered at the time.

3. Allocate that amount on your books to recognize the revenue once the business obligation has been satisfied.

Where is unearned revenue recorded?

Deferred revenue (aka unearned revenue) gets recorded on a company’s balance sheet as a liability.

As we mentioned earlier, that’s because it’s something that the business owes until their contractual obligations have been met.

There’s always a risk that a client or customer could back out of a deal, or that your business won’t be able to fulfill the order. So, unearned revenue remains a liability on the books until any risk of having to repay the money is gone.

Is unearned revenue a liability or an asset?

Unearned revenue remains a liability until a product or service has been rendered.

Over time, the liability gradually gets converted into income (earned revenue) as the product or service gets delivered.

Does unearned revenue go on the income statement?

No, unearned revenue will never show up on the income statement.

It remains on the company’s balance sheet (sometimes called a statement of financial position) as either a short-term or long-term liability.

Only revenue that’s been earned or recognized shows up on the income statement.

What is the accounting entry for unearned revenue?

Wondering how to report unearned revenue in your accounting software?

The initial entry for this liability is a debit to cash, and a credit to the unearned revenue account.

Example — Prepayment received from customer:

Debit Cash $100

Credit Unearned Revenue $100

As the business earns revenue, the unearned revenue balance is reduced with a debit, and the revenue account balance is increased with a credit.

Example — When 1/4 of the goods are delivered to the customer:

Debit Unearned Revenue $25

Credit Revenue $25

If a business didn’t account for unearned revenue in this way, and simply recognized all revenue when payment was received, then revenues and profits would both be overstated in that initial period. Then, in future periods, revenues and profits would be understated.

Not properly accounting for unearned revenue would also violate the matching principle for companies using the accrual method of accounting, since expenses would be recognized in later periods after the revenue has already been recognized.

The matching principle states that revenue for a period should match with expenses over the same period to calculate net profit.

What are the tax rules for deferred revenue?

The IRS (Internal Revenue Service) lets private business owners decide between the accrual accounting or cash accounting methods to calculate their taxable income.

Most large corporations use the accrual accounting method and are required to follow GAAP (generally accepted accounting principles).

Companies using the accrual method can make use of unearned revenue to help align income with costs and potentially defer income taxes until later periods when revenue has been earned.

Smaller companies are more likely to use the cash accounting method. Companies that use cash accounting don’t use unearned revenue or follow GAAP.

These companies simply recognize the revenue in full when they receive a payment. They have to pay income tax on the payments they receive, even if the goods or services haven’t been provided yet.

Increase your company’s revenue

Recording unearned revenue is critical if you’re using the accrual accounting method and receiving a lot of advance payments.

Landlords, companies that provide a subscription service, or those in the travel or hospitality industry may receive the majority of their payments for unearned revenue.

Want to know more about financial accounting? Check out our course on How to Read Financial Statements.

Pareto Labs offers engaging on demand courses in business fundamentals. Built to help you elevate your game at work, our courses distill complex business topics — like how to read financial statements, how to manage people, or even how to value a business — into digestible lessons. No business background required. Our library of 200+ lessons will teach you exactly what you need to know to use it at work tomorrow. Sign up for a free trial today to start watching.