The Basics

- “Accounts payable” (AP) refers to a company’s short-term debt to its vendors. The term also refers to the AP department that handles the accounts payable process.

- Accounts payable appears as a liability account on the balance sheet, the associated expense appears on the income statement, and on the cash flow statement this line item is used to convert net income into cash flow.

What are accounts payable (AP)?

“Accounts payable” refers to the money a company owes its vendors for goods or services already received. Think of it as an IOU between businesses that must be paid off in a short period of time.

AP can also refer to a company’s accounts payable department, which is responsible for handling the accounts payable process and making payments. The AP department usually handles internal expenses as well, such as business and travel expenses.

What’s included in accounts payable?

For example, many companies retain regular cleaning services on credit. An office may hire a cleaning agency to come multiple times per week, and then pay after the fact on a bi-weekly basis.

It’s also common for companies to buy office supplies through automatic bulk orders that are arranged ahead of time based on their needs, leaving them with pending payments to complete.

Accounts payable vs. trade payables

When a purchase made on credit is specifically for inventory, that’s a slightly different kind of short- term debt known as “trade payables.” For example, if a corner store purchases produce on credit to sell in its store, that’s a trade payable. Trade payables are a type of accounts payable.

Accounts payable vs. accounts receivable

You can also think of accounts payable as the opposite of accounts receivable, which refers to money owed to a company, typically by its customers. In the above examples, the same transactions that fall under accounts payable for the office would be categorized as accounts receivable for the cleaning service and office supply company.

Accounts payable vs. accrued expenses

Accounts payable are distinct from other liabilities on a balance sheet in that they only include money owed for goods and services that have been invoiced already. Other liabilities include accrued expenses, which are funds the business expects to owe an employee or a vendor or anyone else, but which hasn’t been invoiced yet.

Here are two examples of accrued expenses:

- Services like wifi or phone service. For every day you receive phone service, you know you are going to owe the phone company for the service you got that day, but your invoice gets sent to you in the middle of the following month.

- Office rent. You know that your business will spend a certain dollar amount on rent each month, but you aren’t invoiced for rent until the first day of each month.

- Payroll. Every day an employee works for the company, we accrue that expense even though we know we wait until the first of the month to issue paychecks.

Where do accounts payable appear on a company’s financial statements?

Accounts payable can be found in several places throughout a company’s financial statements.

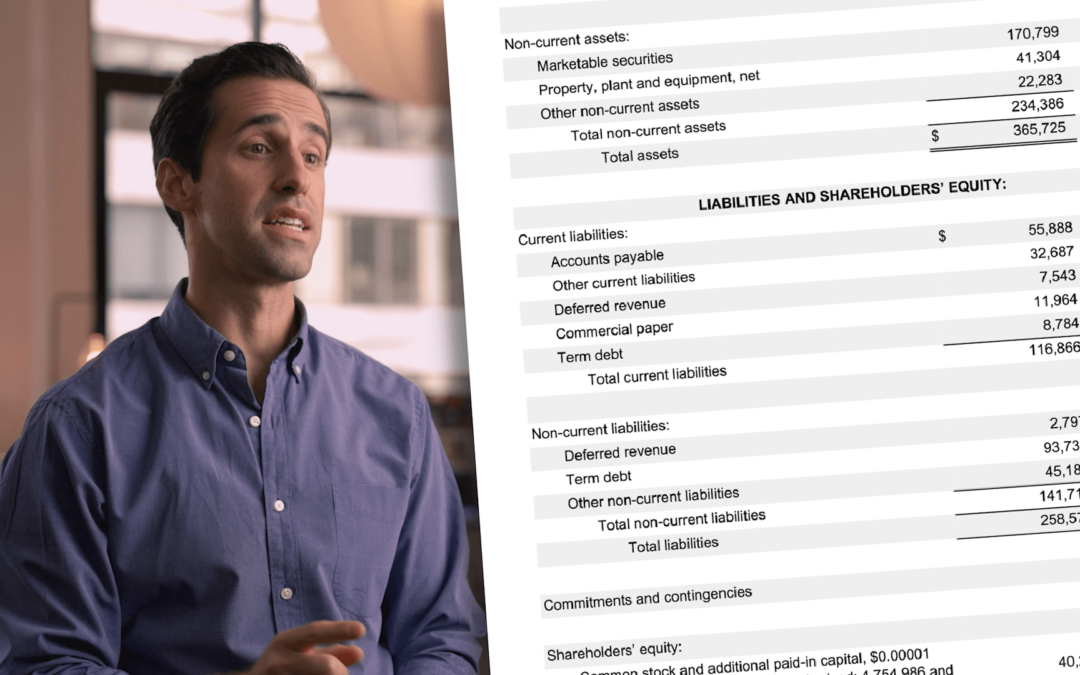

On the balance sheet

Accounts payable appears in the current liabilities section as a liability account when using the accrual accounting method. Since a balance sheet is a snapshot in time, the amount listed under “accounts payable” on the balance sheet represents the total amount of short-term debts owed to all suppliers at the time. If the company is using the cash account method, then accounts payable would not appear on the balance sheet because transactions are only accounted for when cash changes hands.

On the income statement

When a good or service is purchased and received, but not yet paid for, the operating expense will appear as a regular expense on the income statement and the same amount will be added to Accounts Payable.

On the cash flow statement

Cash flow statements reconcile net income to calculate how much cash entered or exited the company’s bank account, so AP appears as a positive value there. In this case the amount is added back to net income to account for the fact that cash has not been paid yet even though the expense was already recorded.

Why are accounts payable important?

Effectively managing accounts payable is a crucial part of running a business. It can have a significant impact on cash flow and the overall health of a business.

To understand how effective your company is managing accounts payable, and thus get a clear picture of your cash flow, look to your average payable period. This accounting measure indicates how long you use credit before paying it off. The longer the average payable period, the better you’re maximizing your credit and working each dollar in your cash flow.

What are some best practices for accounts payable recording and bookkeeping?

When managed correctly, accounts payable can have a positive impact on a company’s bottom line. Here are three tips for making sure your accounts payable process runs smoothly:

1. Pay bills on time.

It’s important to always prioritize bills by due date and adhere to the payment terms. This often means paying within 30 days of when an invoice is received.

2. Make sure the right team members (and only the right team members) are involved.

Accounts payables isn’t a part of the business where anyone and everyone can freely contribute. Financial statements are sensitive business information, and giving too many people access can leave your company vulnerable to mistakes and even fraud. But while visibility into AP should be restricted, it’s important to have more than one person involved to catch any potential issues. An organized, streamlined process with defined roles and a clear review process is essential.

3. Consider automation.

Today, there are various automated services and solutions available that can streamline your accounts payables process. This can reduce costs and help reduce errors.

Pareto Labs offers engaging on demand courses in business fundamentals. Built to help you elevate your game at work, our courses distill complex business topics — like how to read financial statements, how to manage people, or even how to value a business — into digestible lessons. No business background required. Our library of 200+ lessons will teach you exactly what you need to know to use it at work tomorrow. Sign up for a free trial today to start watching.