What is a cash flow statement?

A cash flow statement measures how well a company manages its cash position. In other words: Does the business bring in enough cash to pay its debt obligations and fund its expenses? Even profitable companies may not manage their cash flow well, which is why a cash flow statement is an indispensable tool for companies, analysts, and investors.

Investors look closely at how a company’s operations are running, how its cash is being spent, and where that money is coming from. A company’s creditors will want to know how liquid a business is—meaning, how much cash or assets that can quickly be converted to cash it has on hand.

Management needs to know how much cash the business currently has and expects to have in the future, so they can raise capital or make changes in operations before cash runs out.

The cash flow statement is one of three financial statements all companies use. Together with the income statement and the balance sheet, the three reports paint a comprehensive picture of a company’s assets, liabilities, profits and losses, and income. Every line item and number on the cash flow statement can be calculated using the income statement and the balance sheet.

How to read a cash flow statement

There are three parts in every cash flow statement: operating activities, investing activities, and financing activities. Being able to understand how these impact cash in and cash out helps companies more efficiently manage their cash.

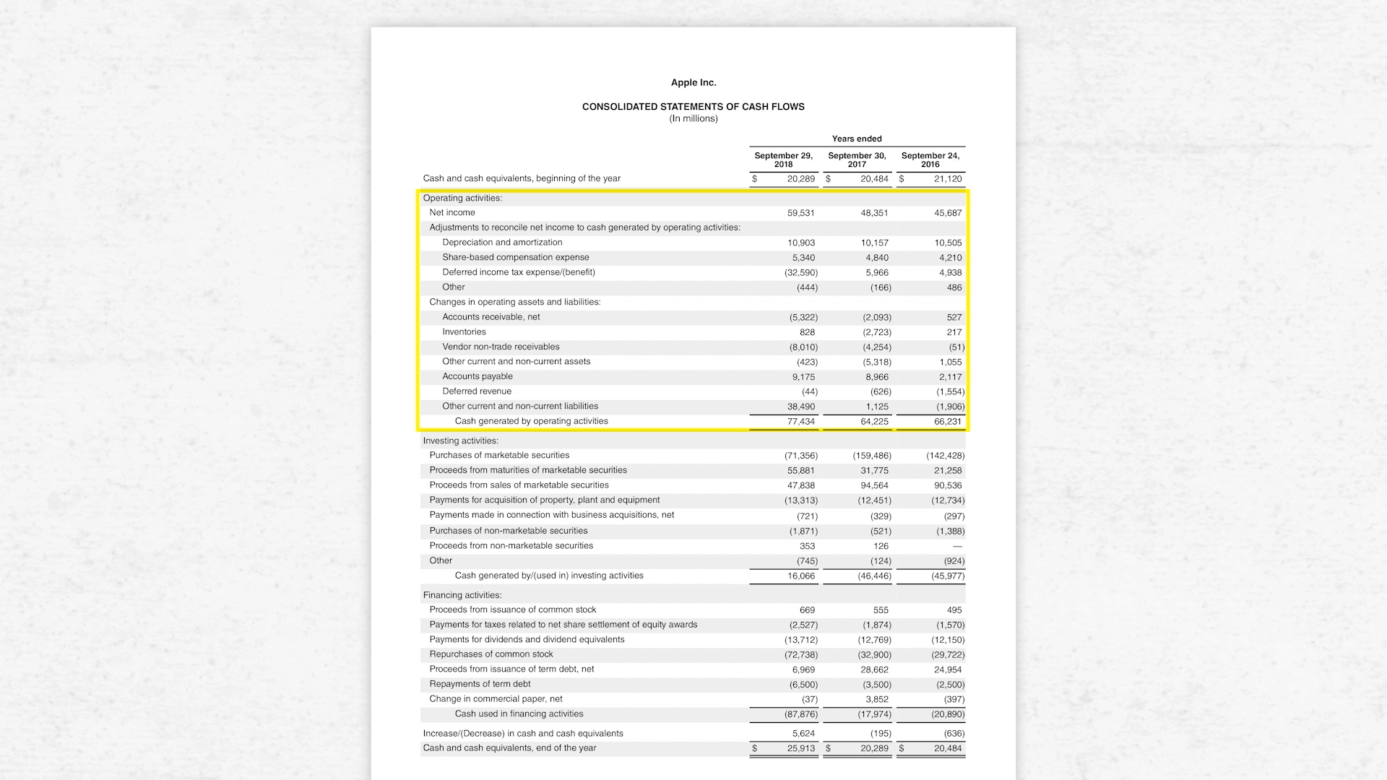

1. Operating activities

The operating activities measure all the cash that’s coming in and going out tied to business operations. Cash comes in when customers pay their bills ,and cash goes out when the company pays its vendors and suppliers.

At the top, you’ll always start with net income. This is the same number that’s at the bottom of the income statement, and that’s how these two statements are tied together. Net income is a company’s total profits—but that’s not the same as cash. To calculate cash, a company must take the net income number and make adjustments to it in order to reflect the cash the company physically has on hand.

Adjustments to reconcile net income to cash generated by operating activities include:

- Depreciation or amortization: Most businesses depreciate assets on a yearly basis. As they depreciate an asset, that year’s depreciation amount will show as a depreciation expense on their income statement. On the cash flow statement, this shows up as an increase in cash flow by the amount of the depreciation expense, since the company did not actually spend cash on the expense.

- Share-based compensation expense: This is the line item that records when employees are paid in stock. It’s an expense because the company is paying employees in exchange for work, but not using cash, so there’s no actual cash going out.

- Deferred income tax expense: This means that the company recognized an increase to net income back on the income statement but didn’t get cash from it. So just like there are non-cash expenses that we add back to net income, there are also non-cash gains that are subtracted from net income.

For cash flow from operations, net income is converted into cash by adjusting that income for the timing of cash entering or exiting a company’s bank account.

Changes in operating assets and liabilities include:

- Accounts receivable: The change in accounts receivable from last year to this year can tell a business whether they had a cash outflow or inflow.

- Inventories: When a company buys inventory, they spend money, so that is a cash outflow, but the expense isn’t recognized until the product is sold. The change in inventories from last year to this year tells us how much a company either added or subtracted from net income.

- Vendor non-trade receivables: Vendor receivables is the same as accounts receivable.

- Other current and non-current assets: Other assets that show up means a company used cash to buy assets but they weren’t included in net income.

- Accounts payable: A company received a product or services from a vendor, so it decreased net income, but hasn’t yet paid cash for it, so that change in accounts payable is added to net income.

- Deferred revenue: This is when a company received cash but has not yet delivered the product. The income statement doesn’t show it as revenue but the company needs to show that it received cash.

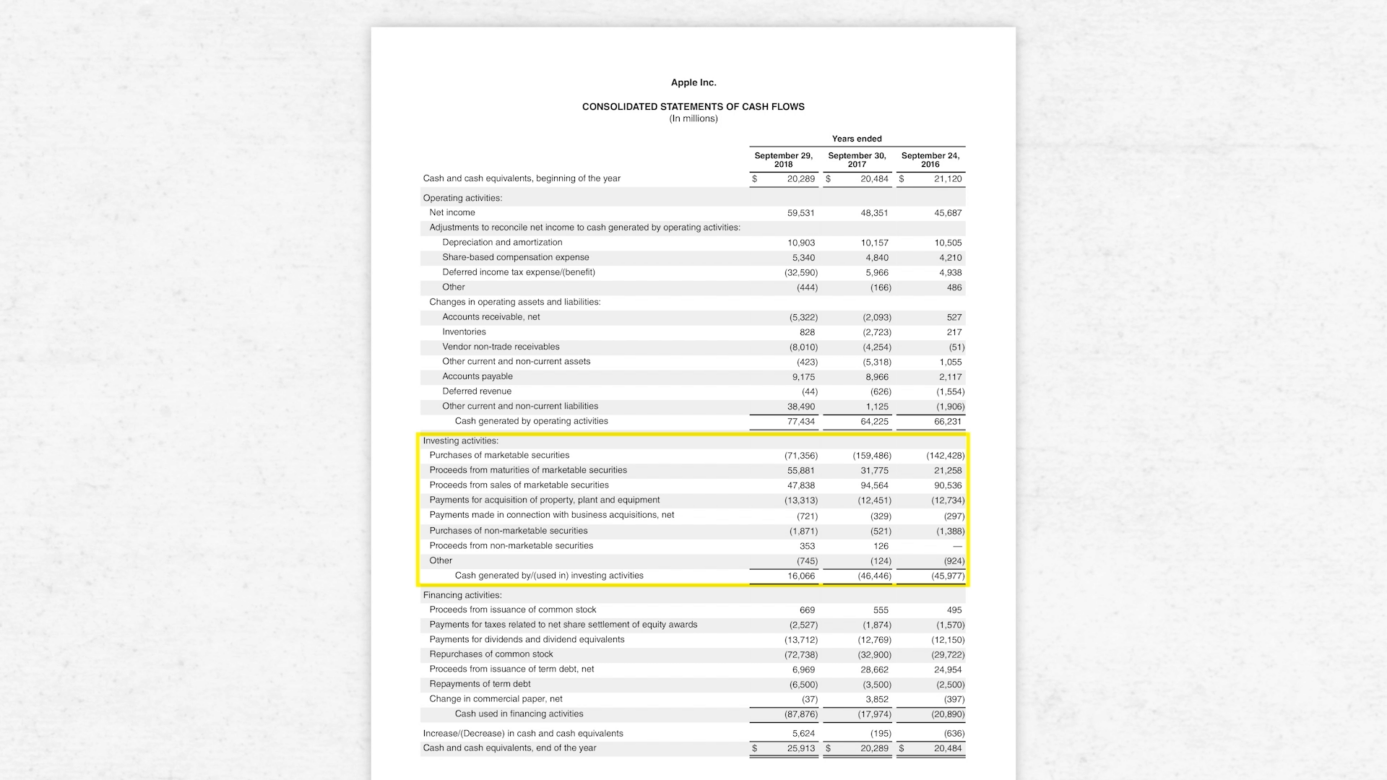

Investing activities

The investing section measures the cash that the company is spending on its future; for example, buying delivery trucks or opening a new manufacturing facility would consume cash now, but these are the types of investments that will hopefully generate more cash in the future. When a company buys assets, it uses up cash, and when it sells assets, it generates cash. This section reflects all the plusses and minuses from buying and selling assets.

The first three inflows and outflows are cash related to marketable securities, which are stocks and bonds that the company owns. This includes:

- Purchases of marketable securities

- Proceeds from maturities of marketable securities

- Proceeds from sales of marketable securities

The next lines include:

- Payments for acquisition of property, plant, and equipment: This is cash used to acquire PP&E. Think of this as the buildings or machines needed to run the business.

- Payments made in connection with business acquisitions: This line is payment for other entire business acquisitions.

- Purchases of non-marketable securities: This last item is cash used to buy non-marketable securities that are not publicly traded.

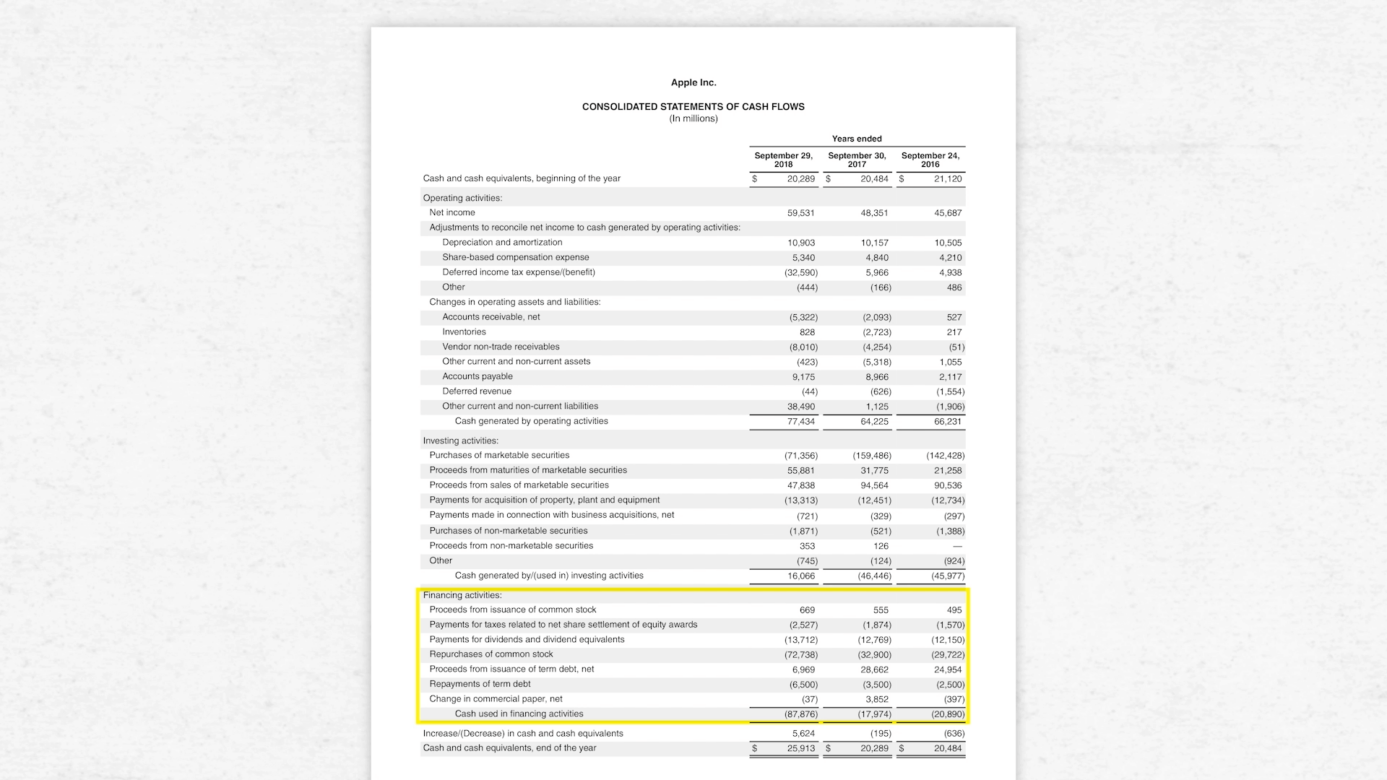

Financing activities

The financing activities section measures how much the company is being powered by outside capital from lenders or shareholders versus its own profits. These are all the plusses and minuses from debt and equity transactions. If a company issues stock, it generates cash. If it raises debt, it generates cash. In the same way, if it buys back stock or pays off debt or even pays dividends to shareholders, that’s cash going out. The financing activities section gives you visibility into all of that.

The first four items are all about stock: issuing it, paying off dividends, a company buying back its stocks:

- Proceeds from issuance of common stock

- Payments for taxes related to net share settlement of equity awards

- Payments for dividends and dividend equivalents

- Repurchase of common stock

The last three items are about debt:

- Raising debt

- Paying off debt

- Changes in commercial paper (a term that refers to short-term debt)

Negative cash flow

Contrary to what you might instinctively think about cash flows, a dip in cash may not signal problems in a company. A negative cash flow may be attributable to a company’s decision to expand at a certain point, for growth in the future. This is why it is important to analyze changes in cash flow from one period to the next: that way, investors and creditors can spot both trends and one-off events that will give them a better idea of how the company is performing over time.

Pareto Labs offers engaging on demand courses in business fundamentals. Built to help you elevate your game at work, our courses distill complex business topics — like how to read financial statements, how to manage people, or even how to value a business — into digestible lessons. No business background required. Our library of 200+ lessons will teach you exactly what you need to know to use it at work tomorrow. Sign up for a free trial today to start watching.