Like it or not, companies live or die based on their financials.

There’s not a single business out there that can succeed without keeping close tabs on its balance sheet — and one way to gauge a company’s financial health is to take a look at its retained earnings (RE).

Retained earnings represent all of the profits a business generates over time that aren’t paid out to shareholders. Retained earnings are kept or reinvested so that the business can pay off its debts or boost operations to supercharge its growth.

There are a couple of different reasons it’s important for a company to work out its retained earnings, and there are also some scenarios in which you have to take retained earnings with a grain of salt.

This guide explains what retained earnings are, how to calculate retained earnings, and why calculating retained earnings is so valuable.

What are retained earnings?

If the term is new to you, don’t stress. Understanding your company’s retained earnings is pretty straightforward.

Retained earnings are the part of your company’s profits that aren’t awarded to a stockholder as a dividend. Instead, retained earnings are usually left to reinvest back into the business. It’s money you keep (retain) in the company.

Sometimes that reinvestment takes the form of saving up for a big new project or product development. But retained earnings are also used by a lot of companies as working capital, capital expenditures, or to pay off liabilities.

For reference, working capital is the amount of money your company has to work with on a daily basis to fund operations. Basically, working capital is the amount of money you have in the bank at your disposal.

Capital expenditures — or “fixed asset purchases” — are things that you buy to upgrade or improve existing assets.

For example, buying the empty field next to your office to turn into an overspill parking lot would count as a capital expenditure.

Then you have your liabilities. Those are just debt obligations your company has, like a small business loan from a bank.

Retained earnings are usually positive, as they’re a part of your company’s profits. But if your retained earnings are negative, this is known as an “accumulated deficit.”

If you have an accumulated deficit, it means that your business is running at a loss.

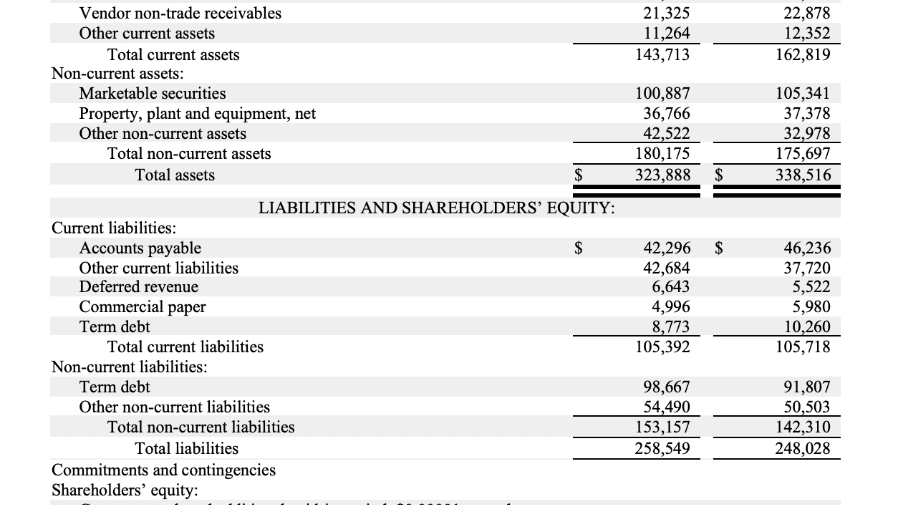

If you’re looking for your retained earnings balance, you can find it under the shareholders’ equity section of your balance sheet.

If you want to conduct some research and development (R&D), buy new equipment, or conduct a big marketing campaign to expand your brand reach, you can use retained earnings to fund those activities.

In turn, those activities will hopefully help you generate more revenue and increase profits even more.

If a company’s retained earnings aren’t going to provide a big enough return on investment (ROI), those earnings will often be distributed to a shareholder as a cash dividend instead.

That just means if you end up with a slim amount of profit at the end of a quarter and it’s not enough to crack a dent in your list of projects, you can give your company shareholders a little boost and reward them with a stock dividend payment.

How do you calculate retained earnings?

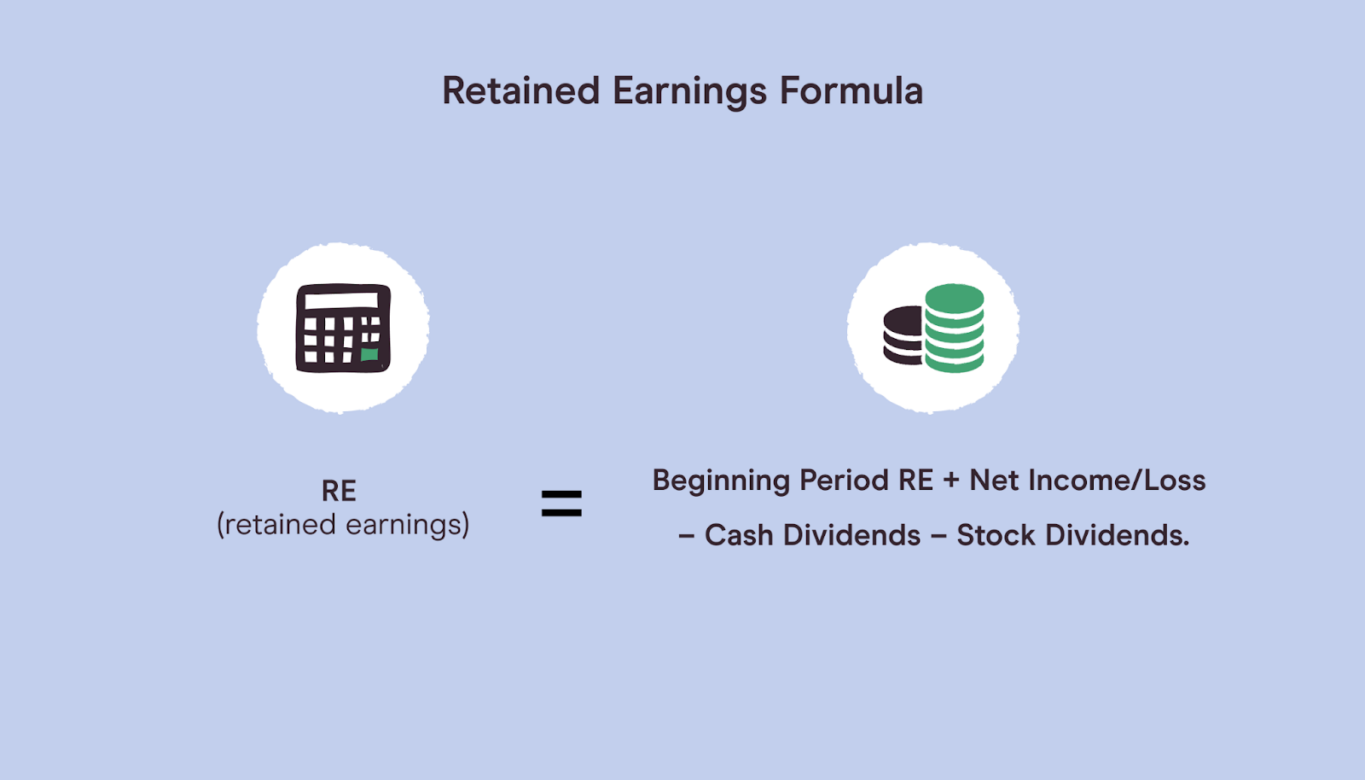

If you need to do a retained earnings calculation, there’s a pretty simple formula that you can use.

The retained earnings formula is:

- Retained earnings (RE) = beginning retained earnings + net income (or net loss) – cash dividends – stock dividends

There’s a bit of financial jargon in there, so let’s break this down.

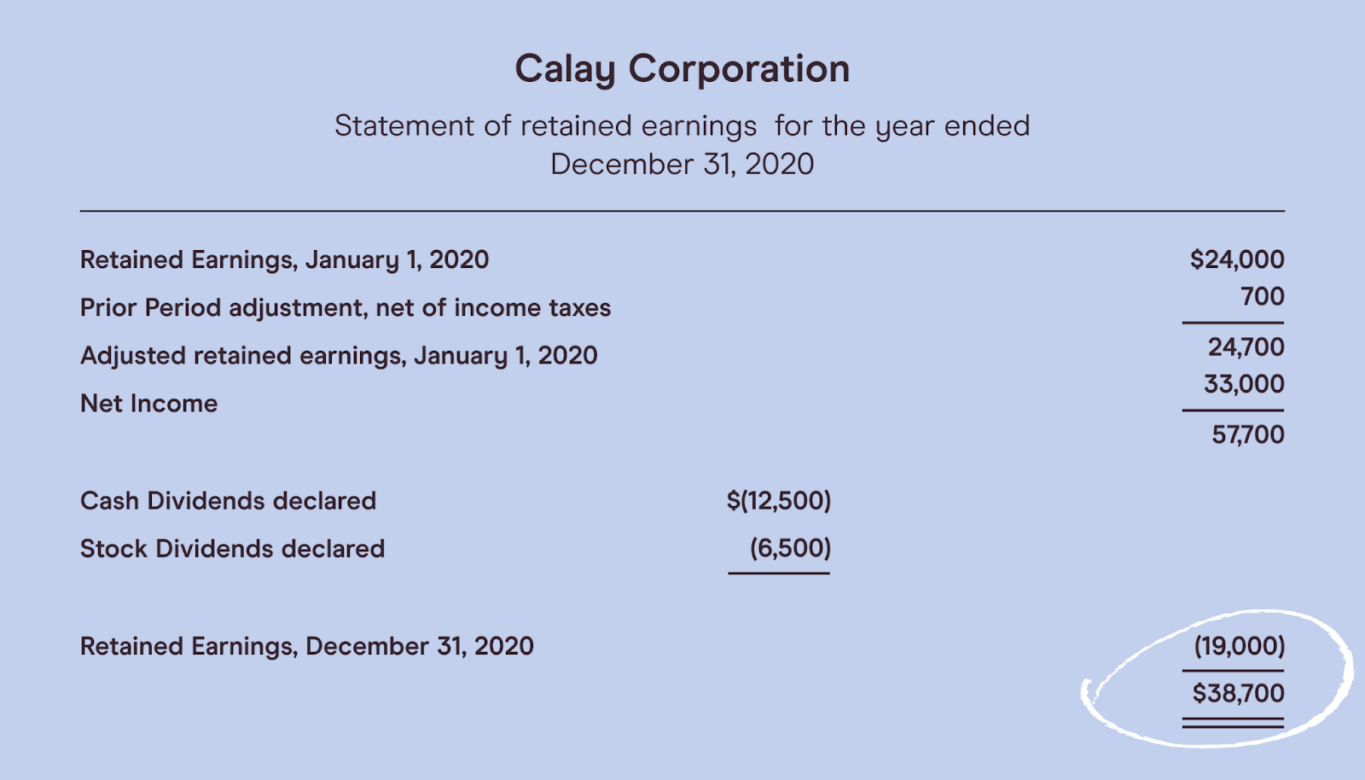

In your first year of business, your net profit at the end of the year will be your retained earnings (as long as you didn’t give out any dividends). From then on, your beginning retained earnings will always just be the balance you finished with the year before.

Next, you’ve got your net income or net loss.

Your net income is how much money your business has left after it’s paid the cost of goods sold (COGS), expenses, depreciation and amortization, interest, and taxes.

Depreciation covers how much value your assets have lost over time. Amortization is the process of paying back a business loan or asset over time.

Then you have your dividends to subtract.

A cash dividend represents the amount of money that you pay to stock shareholders. On your balance sheet, this cash generally comes out of your company’s current earnings or current retained earnings.

Finally, you’ve got stock dividends. These are dividends awarded to shareholders that take the form of additional stock shares rather than cash.

Why are retained earnings important?

Generating retained earnings is a goal for most businesses that are small or are trying to scale up and get bigger.

Why are retained earnings so important?

First and foremost, retained earnings are critical if you want to be able to pay off debt and fund operations — it represents the extra money you’re keeping in the company for future use.

When a company is trying to grow, it’ll typically try to avoid distributing dividend payments so that it can use any retained earnings balance to keep scaling up.

Alternatively, it might invest in capital expenditures, marketing campaigns, or R&D, or it might acquire new assets or smaller businesses.

Similarly, having healthy retained earnings is also a great way for start-ups to attract new investors or get additional funding.

That’s because it shows investors and lenders that your business is generating profit, which indicates you’ll be able to repay a business loan or offer ROI (return on investment) for investors.

In turn, those activities will hopefully help you generate more revenue and/or reduce expenses and increase profits even more.

Companies will sometimes hold on to retained earnings as a reserve.

This is often done because the business is expecting a future loss — which you may incur if there’s an active or incoming lawsuit against your company or you’re planning to sell a subsidiary at a loss.

It’s also important to note that not every business wants to hold onto its retained earnings.

When a business starts to reach maturity and its growth levels slow down, there’s not always much of a reason to hoard retained earnings.

If your business isn’t in debt and you don’t have any projects on the horizon that you need to fund, you might prefer to give that profit back to your investors in the form of distributed dividends.

Companies with really strong working capital policies will also often choose to go for a dividend payout to stockholders as a way to reduce cash on hand.

On the flip side, you might want to use your retained earnings to buy back shares of company stock rather than pay dividends.

Generally speaking, stock buyback campaigns are designed to increase the share price of a company — thus increasing its value.

How do you analyze retained earnings?

If you want to analyze the retained earnings of a business, you should bear a couple of things in mind.

The first point to consider is the stage of a business.

Just like a lot of other metrics designed to measure financial performance, sometimes you should take retained earnings with a grain of salt — at least if you’re analyzing somebody else’s company instead of your own.

When you look at a company that’s been operating for a really long amount of time, an accumulated deficit (or negative retained earnings) could be a warning sign that the business needs financial help.

After all, if you’re regularly running your business at a loss, this suggests that you need to boost your revenues to start breaking even.

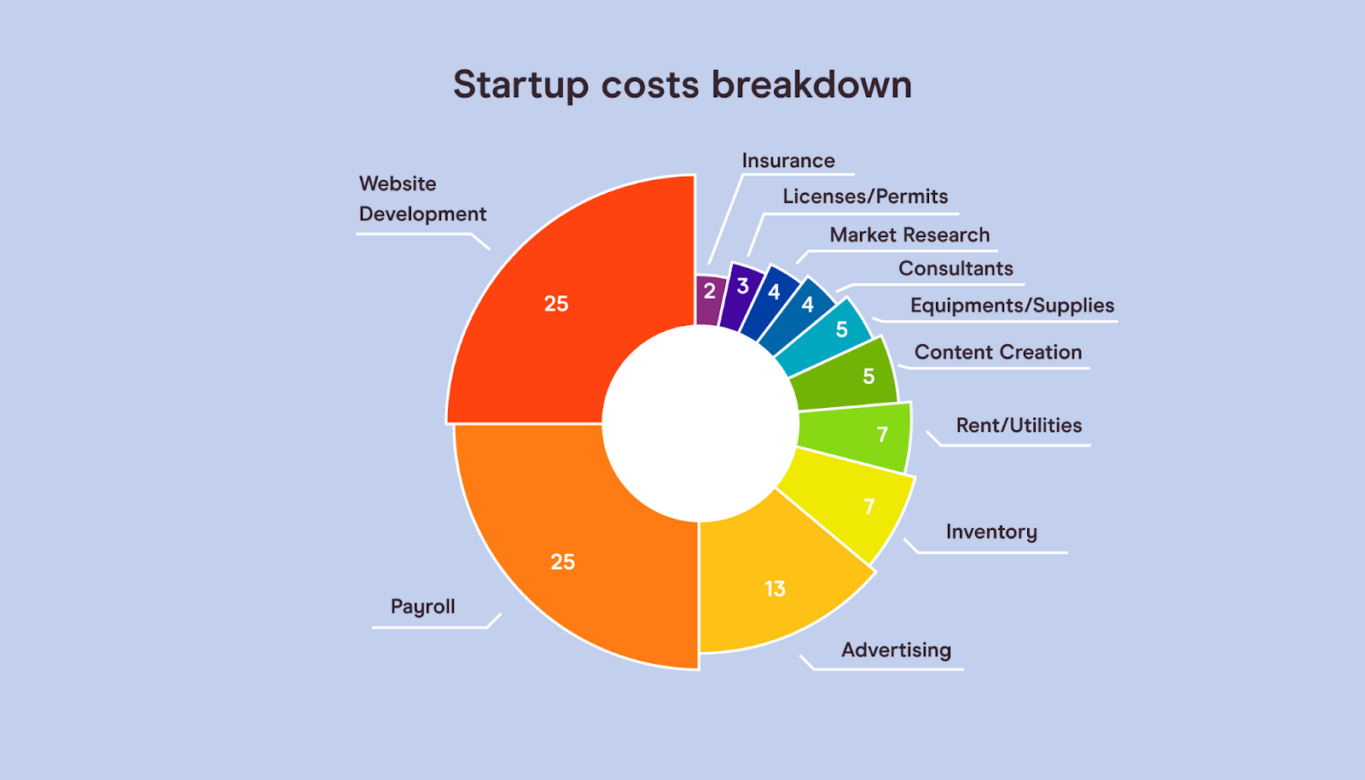

But you shouldn’t necessarily fear for a brand-new start-up running an accumulated deficit. Start-up costs can be incredibly ridiculous — from web development and payroll to advertising, insurance, rent, utilities, content creation, and everything in between.

That means when you start a new company, you’ll generally need to take on a lot of debt (or equity) to get going and run at a loss for many years.

You should also think about historical trends and industry averages when looking at RE.

For example, you might be looking at a business with low retained earnings — which could indicate that the business isn’t the most profitable.

But if all of its competitors are running at a loss with an accumulated deficit, a slim RE may be healthy. It’s simply a different industry dynamic.

Likewise, you might stumble on a company with super impressive retained earnings for a given year.

But if you look at its historical RE over a longer period of time, you might find that the business always gets a big profit boost after a federal election — and then has three years’ worth of accumulated deficit.

Conclusion

Even though you need to take retained earnings with a grain of salt, they are an incredibly important metric that both company managers and investors alike need to keep track of.

But while generating retained earnings is a goal for many companies, it’s important to note that not all businesses want to hold onto those earnings. Some businesses may choose to distribute dividends instead.

Ready to learn more about how to calculate retained earnings? Check out Pareto Labs’ wide range of business masterclasses. They can help you to develop all the practical skills you need to make a difference at your company — and they’re taught by real practitioners, not academics.