If your business isn’t generating revenue, you’re not going to have a business for very long. You have to keep close tabs on what your company is bringing in.

But even then, simply knowing about your revenue isn’t going to be enough. To be successful, you can’t just make sales and hope for the best — you need to generate a profit.

Want to figure out whether your business is profitable and get a crystal clear picture of how your business is performing? That’s where net income steps in.

Net income is the amount of money you’ve got after you subtract the cost of goods sold, overheads, taxes, interest, and other expenses from your revenue — and it can tell you a lot about how your business is doing and where it’s headed.

This guide explains what net income is and how to calculate it. It also provides an example of how to find a business’ net income from a balance sheet.

What is net income?

Before we speed right onto how you can calculate net income, let’s pump the brakes and revisit what net income actually is.

Simply put, net income is how much money your company has brought in after you subtract all of your expenses, depreciation, interest, and taxes. There’s a little bit of jargon involved from here on out, so we’ll walk you through it really quickly.

Terms you need to know when finding net income

First off, depreciation is a representation of an asset’s cost over its useful life. On your balance sheet or income statement, depreciation is designed to show the part of an asset that’s been used or consumed over a particular accounting period.

Taxes are a bit more self-explanatory — everybody has to pay them, and they vary from person to person and from business to business.

But let’s talk about interest.

Your company’s interest expenses will be one of the core figures on your income statement. All businesses need either debt or equity to finance operations.

If you’ve got equity, that’s fantastic. But if you need to take on debt, that normally means getting a business loan from one or more lenders.

When you take out a loan, you can almost always expect there to be an expense associated with the cost of borrowing — which is your annual interest.

By including that interest expense on your income statement, you’ll have a way better idea of how your company’s capital structure looks.

Anyway, back to expenses. A company’s expenses can be pretty broad and will generally include things like the cost of goods sold (COGS), administrative expenses, and operating expenses.

If it’s new to you, COGS is simply a measure of the direct cost your business has to pay to produce the goods it sells.

Other names for net income

You might also hear people call net income by a couple of other names. Some organizations refer to net income as “net earnings,” and in the UK, net income is often called “profit attributable to shareholders.”

But more often than not, you’ll probably hear net income referred to as “net profit.”

Although income and profit are normally considered two different figures, net income and net profit are both the same thing.

Net income might be the same as net profit and net earnings, but it’s totally different from gross income and gross profit.

Net income vs gross income vs gross profit

Gross income usually refers to personal income rather than business income. It’s a figure that represents all the money earned before any expenses or reductions. For instance, on your paycheck, gross income is the amount before deductions. In the case of a business, this would equal total revenue.

Gross profit is a measure of a company’s revenue minus its COGS.

By contrast, your net income takes into account all of the federal or state taxes, asset depreciation, interest, and any other expenses.

Investors like to use net income to figure out whether a business is making more money than it’s spending. Net income is also critical to help shareholders figure out a company’s earnings per share (EPS).

EPS is a company’s profit divided by the number of outstanding stock shares it has — which then indicates how profitable a company is.

How to find net income

Net income is an incredibly important metric for companies wanting to figure out whether their business is actually turning a profit. Fortunately, it’s also pretty easy to find net income.

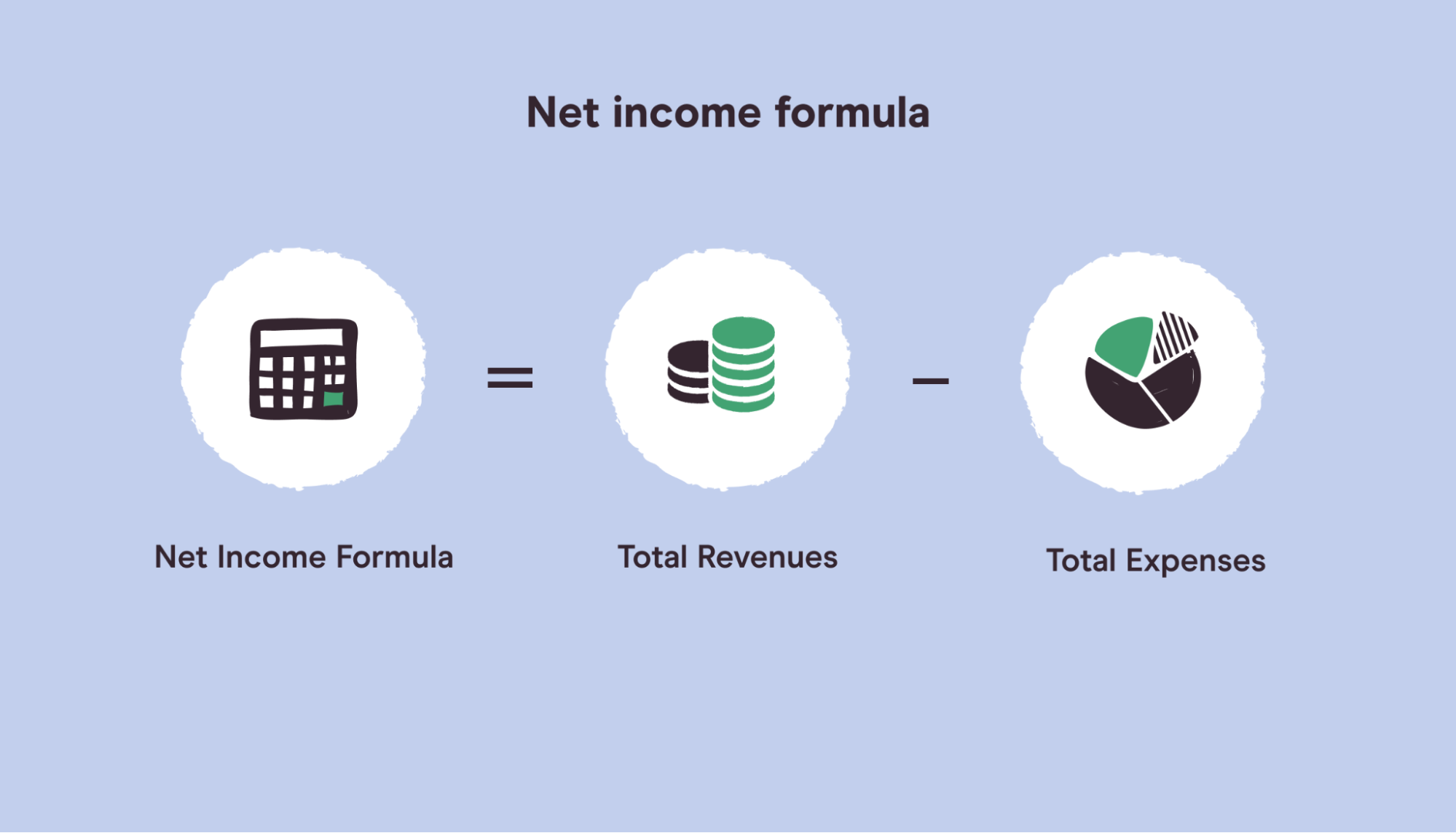

You can calculate your company’s net income using a pretty simple formula:

Net income = revenue – COGS – expenses

The first part of the net income formula — which is your revenue minus COGS — is the formula you would use to figure out your company’s gross income, too.

Bearing that in mind, it’s also possible to calculate net income using another formula. That formula is: net income = gross income – expenses.

If you want to simplify things a bit more, the net income formula can be broken down even further to be just: net income = total revenues – total expenses.

No matter which formula you decide to go for, you should arrive at the same number. As long as you’ve got all the correct data at hand, figuring out your net income should be a walk in the park.

But all of these formulas and calculations will normally be carried out by a company’s finance or accounting team to create an income statement.

You will also find net income on your company’s balance sheet or your cash flow statement because net income is always shown as a single line item on these financial statements.

Finally, it’s important to bear in mind that your company’s net income can either be positive or negative.

If your business has more revenues than expenses, it means that you have a positive net income.

On the flip side, if your company’s total expenses are bigger than the revenue you’re bringing in, it means you have a negative net income. This is also often referred to as running a “net loss.”

What is an example of net income?

Net income isn’t very complicated once you get the hang of it. But sometimes, it helps if you’re working with an example.

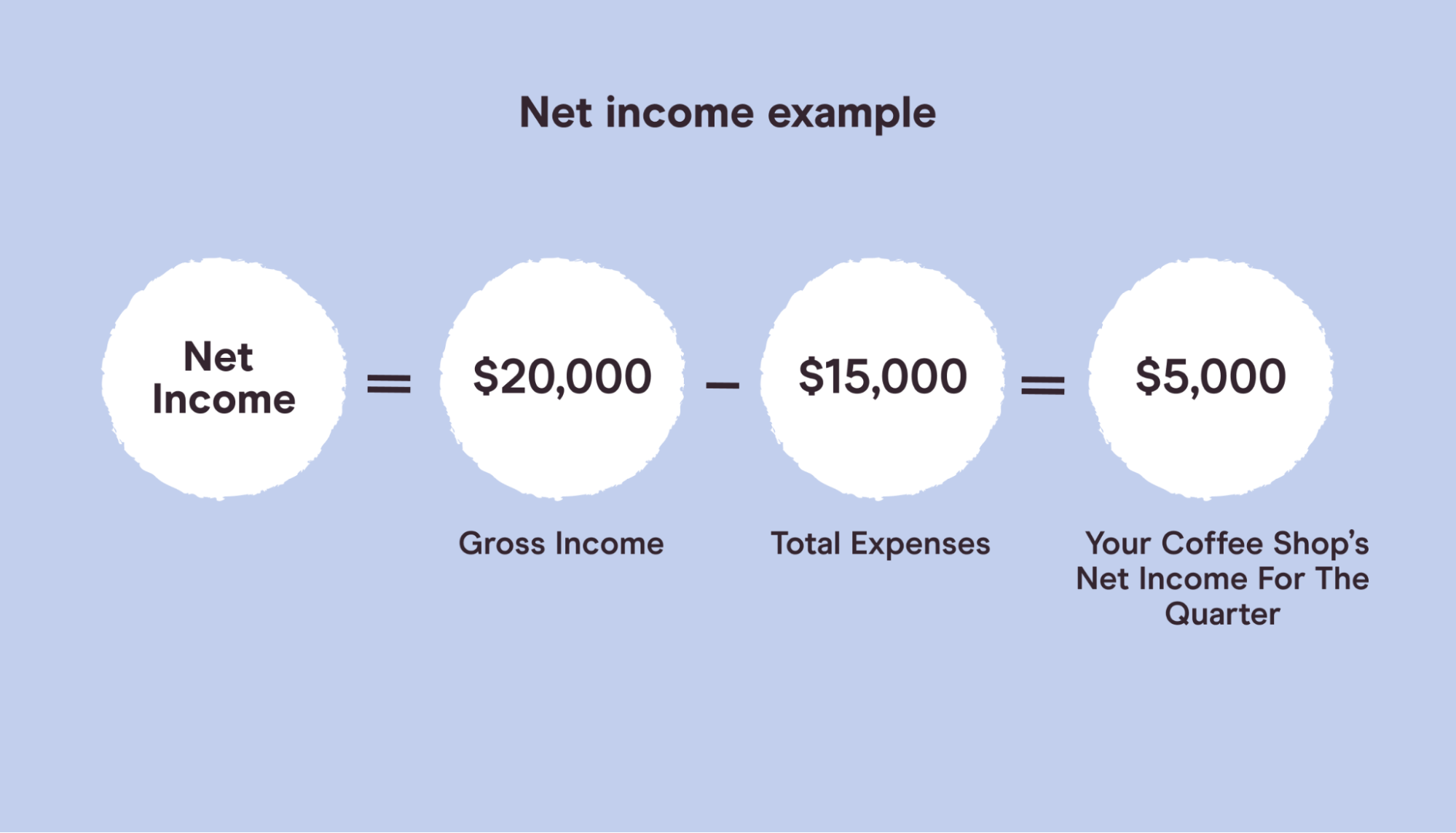

Let’s say that you and a friend run a coffee shop. You’d like to see how your coffee shop has been doing as a business over the summer, and so you’re going to want to calculate its net income for the third quarter of 2021.

To find your company’s net income, you would need to have all of your financial data at hand, including how much you’ve made and all your expenses.

Here are the numbers you’ve got to work with:

- Total revenue: $50,000

- Cost of goods sold (COGS): $30,000

- Company payroll: $5,000

- Premises rent: $5,000

- Utility bills: $2,500

- Marketing and advertising: $500

- Interest expenses: $1,500

- Taxes: $500

Once you’ve got all your financials handy, the first thing you’d have to do is calculate your coffee shop’s gross income. You’d do that by taking your total revenue and then subtracting your COGS.

That means you’d just subtract $50,000 – $30,000. Your gross profit is $20,000.

Your next step would be to add up all your other expenses. That means taking your company payroll expenses, the rent for your company premises, utility bills, marketing costs, and any expenses that have popped up from interest.

This should add up to $15,000.

Finally, all you need to do to find your net income is to subtract total expenses from your gross income. In this case, that’s just taking $20,000 – $15,000.

The number you have left — $5,000 — is your coffee shop’s net income.

By having a firm grasp on your company’s net income, you and your partner will be able to develop a better idea of just how profitable your coffee shop really is.

If your net income is positive, you might be able to use that information to attract new investors.

But if your coffee shop’s net income is negative, it should serve as a red flag that you might have to switch things up to try and become more profitable.

Conclusion

Net income is an incredibly important metric. It’s essentially a representation of the amount of money that your company has left after you pay all of your business expenses.

And the number you have at the end can then be used by the company to pay dividends to shareholders, invest in new projects or equipment, pay off your debts, or store away for a rainy day.

Fortunately, the formula for working out your net income is pretty simple, too.

All you’ve got to do is subtract your cost of goods sold (COGS) and expenses from your revenue. From there, you can use your positive net income to attract new investors — or use your negative net income to inform important decisions.

Do you want to learn more about what drives your team’s net income?

Check out Pareto Labs’ wide range of business masterclasses. They can help you to develop the practical skills you need to make a difference at your company — and they’re taught by real practitioners instead of academics.