What is an income statement?

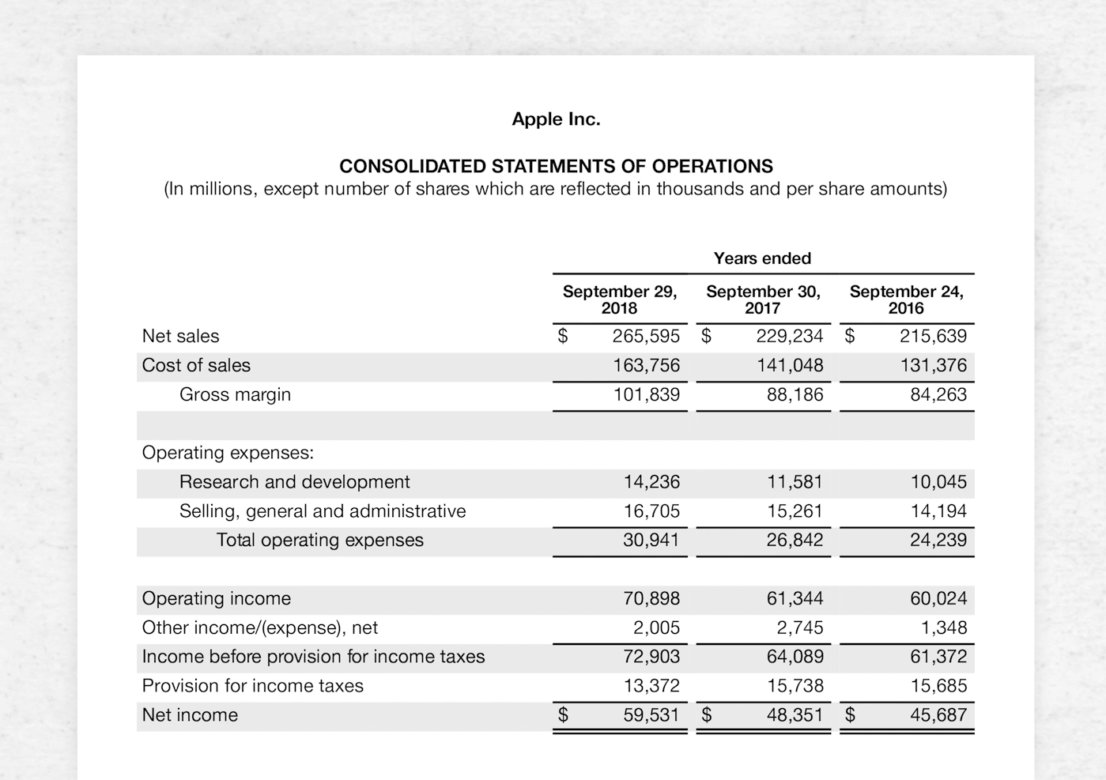

One of three financial statements that every company uses to track their financial performance, the income statement shows the amount of sales, expenses, and profit flowing through a business over a period of time. This statement is sometimes called the Profit and Loss Statement, or “P&L” for short.

You can do a simple analysis of income statements to see exactly what percentage of revenue is spent on making products versus what is spent on overhead, and what percentage is left over as profit.

How to read an income statement

The income statement begins with revenue, which is referred to as the “top line,” and ends with net income, which is referred to as “the bottom line.” The bottom line shows a company’s profitability after all its costs are accounted for.

Income statements are divided into two main sections: above the line and below the line. Here’s what’s contained in each.

Above the line

- Revenue, AKA net sales: Revenue represents the product or services that the company sold and delivered to its customers. It answers the question: “How much product or services did the company sell and deliver to the customer?” (Note: Revenue is not the same as cash. You only record revenue when a product or service is delivered—regardless of when the customer paid for it.)

- Cost of sales, AKA cost of goods sold (COGS): Money spent on making the product. It answers the question: “How much did the company pay for all the ingredients in the product that was sold?” This cost is recognized at the same time as the revenue.

- Gross margin, AKA gross profit. This is simply the difference between what a company sold to customers and how much it cost to make the product. The margin is how much the company has left over to pay all the other expenses a business incurs.

Below the line

- Operating expenses: These are costs a company incurs during the ordinary course of business. These aren’t considered “ingredients” in making the product, but rather the “overhead” of running a business, which includes everything from rent, marketing, payroll, and inventory, to research and development.

- Operating income: This figure shows the profit a business makes from its operations, after deducting operating expenses like wages, depreciation, and cost of goods sold. In other words: How much is left after running the business for a period of time.

- Other income: Companies can make other income, or gains, from the sale of assets or the net income from one-time, non-business activities like selling a subsidiary.

- Provision for income taxes: This is the estimated amount that a business expects to pay in taxes. In other words, how much pre-tax income a company made. In the next line, the company takes out taxes.

- Net income, AKA net profit: A company’s total profits after subtracting the cost of all of its expenses from how much revenue the company generated for a certain period. This answers the questions: “Did the company make money, or lose money, and how much?”

What does an income statement tell you about a company?

The income statement’s purpose is to reflect profitability. By looking at three numbers on the income statement, you can learn several key things about a business:

- Gross margin tells you if customers value the company’s product enough to pay more for it than what it costs to make.

- Operating income tells you if the management team is running the business efficiently.

- Net income tells you if a business is profitable over a period of time after all is said and done.

To go a step further in your analysis, you can plug these numbers into financial ratios. Ratios help you understand different aspects of the business’s operations, and compare them to competitors.

- Gross profit margin percentage: By dividing gross margin by net sales, you arrive at gross profit margin percentage. This ratio tells you how much a business makes on every dollar of sales after paying for the ingredients needed to make the product. Generally, the higher the gross profit margin percentage, the better a company is at turning sales into profits.

- Operating profit margin percentage: By dividing operating income by net sales, you arrive at the operating profit margin percentage. This ratio tells you how much a business makes on every dollar of sales after paying for ingredients and overhead. Comparing this ratio to gross profit margin percentage can reveal if a business has a disproportionately high overhead cost.

Income statement vs. balance sheet

Although the income statement and the balance sheet both provide a snapshot of a company’s financials, the balance sheet shows this data as of a particular date, and the income statement reports income through a reporting period. Its heading will indicate that time period, which might read, “For the fiscal year ended September 20, 2020.” The two statements fulfill different purposes: the income statement shows income and expenses, and a balance sheet records assets, liabilities, and equity.

Income statement vs. cash flow

While an income statement measures a company’s financial performance over time, it doesn’t actually tell you how much cash a business has on hand at a given moment.

“Accounting practices are different from cashflow,” explains Elaine Paul, CFO of Amazon Studios and former CFO of Hulu, in Pareto Labs’ class on reading financial statements. “Revenue recognition, and when revenue can hit your top line as top-line revenue coming into the company, is different than when the cash may be hitting the coffers.

“For example, if we were buying a show for, say, $10M, once we signed that deal and they delivered us the series on their books, they could recognize all $10M as revenue,” Paul says. “But our payment terms might’ve been to pay for that over a four or five-year license term. So our cash outflow would be over those four or five years, but the company from whom we could buy, it would be recognizing revenue on paper [on its income statement], right up front.”

Pareto Labs offers engaging on demand courses in business fundamentals. Built to help you elevate your game at work, our courses distill complex business topics — like how to read financial statements, how to manage people, or even how to value a business — into digestible lessons. No business background required. Our library of 200+ lessons will teach you exactly what you need to know to use it at work tomorrow. Sign up for a free trial today to start watching.