Shareholders’ equity is found in the capital section of a balance sheet, as selling ownership in the company is a way to raise capital.

What is shareholders’ equity?

Also known as stockholders’ equity or owners’ equity, shareholders’ equity boils down to the total value of a company after it pays off all of its debts.

Businesses have assets (resources owned or operated by the company that add to its economic value) and liabilities (debts or obligations that detract from its economic value). Shareholders’ equity indicates the money that would belong to the company’s owners and shareholders after it sold all of its assets and took care of all its liabilities. It can also be thought of as the company’s net worth.

Shareholders’ equity is similar to the equity you have in your home. The house is the asset, and the mortgage is the liability. When you subtract the mortgage from the value of the house, that’s your equity. The same concept applies to shareholders’ equity in a company.

Shareholders equity comes from three sources:

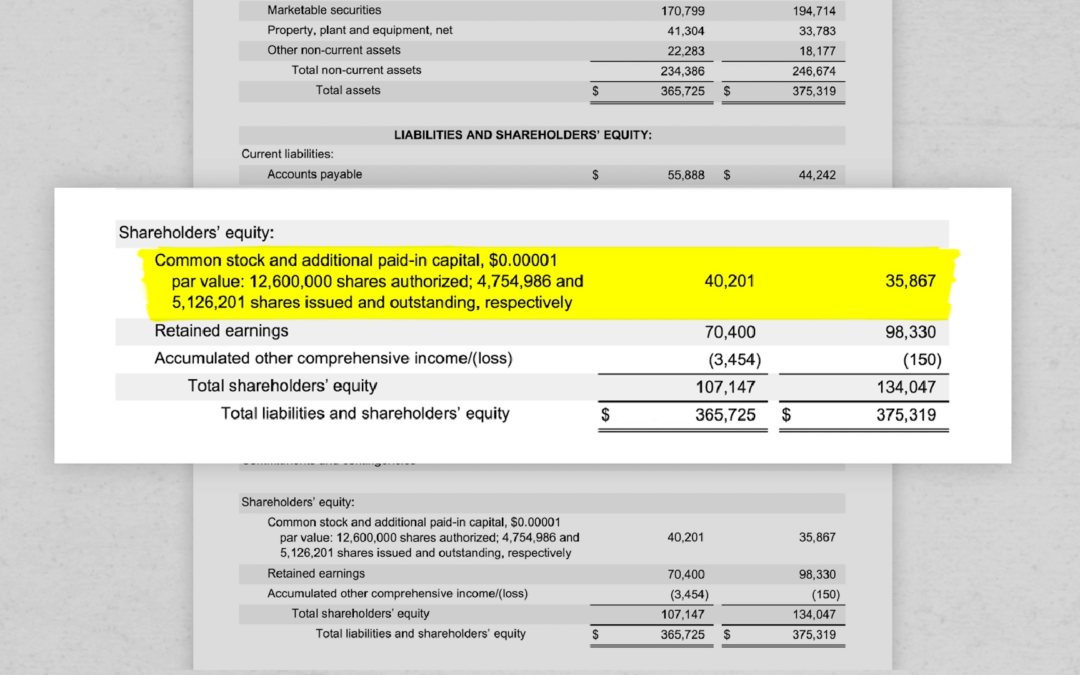

- Common stock and additional paid in capital is the amount of money that investors have paid into the company in exchange for ownership.

- Retained earnings are the net income that a company holds onto for reinvestment. This income is not paid out to shareholders or used to repurchase company stock.

How do you calculate shareholders’ equity?

To calculate stockholders’ equity, you can use one of two accounting equations. The first is the simplest and most commonly used.

Shareholders’ Equity = Total Assets – Total Liabilities

In this shareholders’ equity equation:

- Total assets: All current and long-term assets. These are the things you need to own to run the business.

- Current assets can be converted into cash in less than a year, such as cash, cash equivalents, and accounts receivable.

- Long-term assets can typically be converted to cash over a term longer than one year and can include investments, patents, or property, plant, and equipment.

- Total liabilities: All current and long-term liabilities. Liabilities are money that a business owes other people, and must pay back at some point in the future.

- Current liabilities are debts that are due within a year, such as accounts payable and taxes owed.

- Long-term liabilities are typically due for repayment more than one year out, including leases, long-term loans, and bonds payable.

Shareholders’ equity is adjusted to account for a number of other items found on the balance sheet, including anticipated gains not yet realized and translation on foreign currency.

The second equation for shareholders’ equity is sometimes known as the investors’ formula because it is used specifically by current or potential investors to assess the financial health of the company.

Shareholders’ Equity = Share Capital + Retained Earnings – Treasury Shares

In this investors’ formula of shareholders’ equity:

- Share capital is stock that employees and investors have bought from or been given by the company. These shares can be issued as common stock or preferred stock.

- Retained earnings are the net income that a company holds onto for reinvestment. This income is not paid out to shareholders or used to repurchase company stock.

- Treasury shares are stocks owned by the company itself.

Share capital, retained earnings, and treasury shares are all reported in the shareholders’ equity section of a balance sheet.

What does shareholders’ equity tell you about a company?

Shareholders’ equity provides investors a glimpse into the financial health of a company. Typically, the higher or more positive a company’s shareholders’ equity is, the more flexibility or financial cushion it has to absorb losses or pay off debt.

Negative shareholders’ equity suggests that the company might want to consider reducing its liabilities or finding ways to boost its profits. This distinction is not set in stone. For instance, a lower shareholders’ equity can be overlooked by investors if a new company has other redeeming qualities, such as appealing annual reports or it is in an industry that shows a lot of promise.

Shareholders’ equity does not tell you everything that you need to know about a company, so always look into other indicators of a company’s financial health before making an investment decision. These indicators could include price-to-earnings ratio, industry trends, and dividends paid or distributed to investors.

What is return on equity?

The shareholders’ equity of a company can be used to calculate return on equity, or ROE, which measures how well a company uses investments to drive profit. ROE is calculated by the following equation:

ROE = Net Income / Shareholders’ Equity

In this equation:

- Net income: Total profit minus cost of goods sold, taxes, and other expenses

- Shareholders’ equity: Total assets of a company minus total liabilities

ROE is expressed as a percentage. It measures how much profit the company generates with every dollar invested by shareholders. This can be an especially telling metric for investors who are considering buying an equity stake in the company.

Pareto Labs offers engaging on demand courses in business fundamentals. Built to help you elevate your game at work, our courses distill complex business topics — like how to read financial statements, how to manage people, or even how to value a business — into digestible lessons. No business background required. Our library of 200+ lessons will teach you exactly what you need to know to use it at work tomorrow. Sign up for a free trial today to start watching.