Net income and gross profit are both components of an income statement that demonstrate the profitability of a company—but they do so through different lenses.

The Basics

- Net income is a company’s total profits after subtracting the cost of all of its expenses from revenue generated over a reported period of time.

- Gross profit is a company’s profits after subtracting only the cost of goods sold (COGS) from revenue generated over a reported period of time.

- Net income gives a birds-eye-view of total profit, but it includes non-operating expenses such as tax and interest. Gross profit is limited by its focus on COGS, so it doesn’t include other operating expenses that are required to keep the business running.

What is net income?

If you’ve ever heard the term “the bottom line,” it refers to net income, which is the final line at the bottom of an income statement and is often synonymous with profit. Net income, also sometimes called net profit or net earnings, takes into account all of the expenses of a business including COGS, operating expenses, and other costs like taxes that are not included in the gross profit.

To calculate net income, use this simple equation:

Net income = Revenue – Expenses

In this equation:

- Revenue: Includes operating and non-operating revenue. Non-operating revenue represents cash generated from services or activities outside of the company’s core business, such as interest earned on cash in the bank or income from partnerships like affiliate programming or royalty payments.

- Expenses (operating): Includes primary and secondary expenses like operating expenses which are the costs associated with helping the business run. These could include rent, utilities, or research and development.

- Expenses (other): Additional expenses subtracted from revenue to discern net income include: interest on debts, company credit cards, and loans, overhead, income tax, depreciation, income from short-term investments, the sale of assets, and more.

To break out more detail, use this expanded equation:

Net income = Revenue – COGS – Operating Expenses – Taxes – Interest

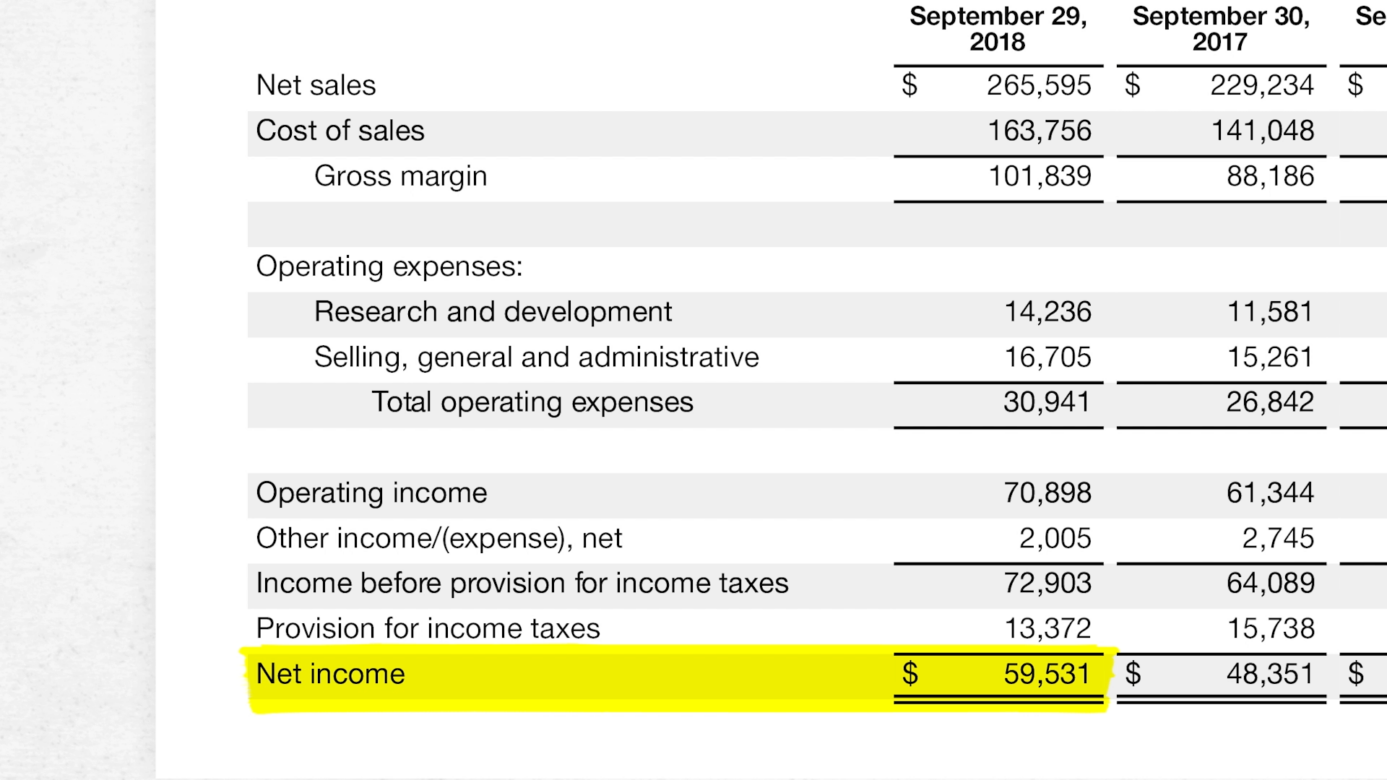

Net income example

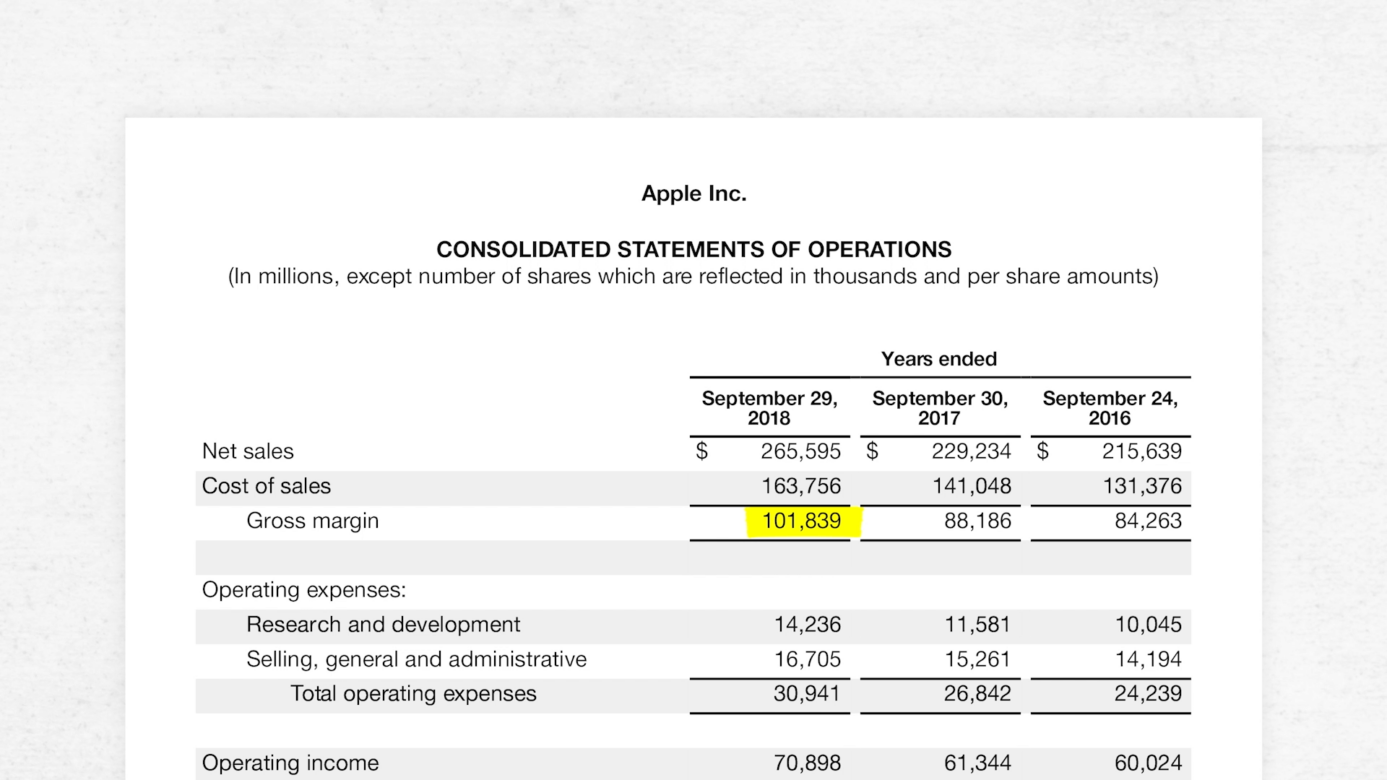

Consider Apple’s 2018 consolidated statement of operations. Apple reported the following totals (rounded for ease):

- Total revenue (referred to as “net sales”) of $265 billion

- Total COGS of $164 billion

- Total operating expenses of $31 billion.

- $2 billion of other income.

- Income taxes of $13 billion.

- Net income of $59 billion.

What is gross profit?

Gross profit is the difference between what a business sold to customers (revenue or net sales) and how much it cost to make the thing they sold them (cost of goods sold/“COGS”). Net income encompasses gross profit and expands upon it by adding overhead expenses, taxes, and income not tied to sales into the mix.

To calculate gross profit, subtract cost of goods sold (COGS) from the total revenue:

Gross profit = Revenue – COGS

In the this equation:

- Revenue: Cash generated by the sale of a company’s core product or service offering.

- COGS (Cost of Goods Sold): The total cost of every ingredient that went into a good or service that is sold, which may include both physical components of the good as well as the wages of the people who actually assembled it. It might be referred to on the income statement as “cost of sales.”

In the case of Apple, they refer to revenue as “net sales,” as “cost of sales,” and gross profit as “gross margin.”

Net income vs. gross profit: What each tells you about a business

Net income answers the ultimate question—after accounting for all revenue and all expenses, did we make money or lose money, and how much? Net income’s measure of profitability factors in all categories of expenses—which means you get a complete picture of profit. What you don’t get is a granular breakdown of the business’s categories of expenses that impact the bottom line.

Gross profit, on the other hand, looks specifically at production costs and does not include operating expenses. This gives you a sense of the profitability of the goods or services the business sells, but it doesn’t tell you how overhead costs impact overall profits.

When you’re reading an income statement, the limitations of gross income and net income can skew your understanding of a company’s profitability. It’s important to look through multiple lenses and only draw conclusions once you have looked at both metrics from multiple angles and how those metrics feed into or inform other financial statements like the cash flow statement.

For example, net income doesn’t tell you exactly where certain types of revenues and expenses originate. If the product is not selling well or is costing more to produce than customers will pay for it, profitable investments and sales of assets in the net income could hide the actual profitability of the company’s product.

Pareto Labs offers engaging on demand courses in business fundamentals. Built to help you elevate your game at work, our courses distill complex business topics — like how to read financial statements, how to manage people, or even how to value a business — into digestible lessons. No business background required. Our library of 200+ lessons will teach you exactly what you need to know to use it at work tomorrow. Sign up for a free trial today to start watching.