The Basics

- Deferred revenue refers to payment received in advance of a business delivering a product or service.

- A company will record deferred revenue first as a liability on the balance sheet, then—after goods or services have been delivered—as earned revenue on the income statement.

- Deferred revenue is an accrual accounting practice, which only allows a company to recognize revenue and expenses when a transaction occurs, not just when the advance payment is sent or received.

What is deferred revenue?

Deferred revenue, also known as unearned revenue, refers to a payment that a company receives in advance from a client or customer before delivering a product or service.

In other words, deferred revenue accounts for payments that have not yet been earned by the company.

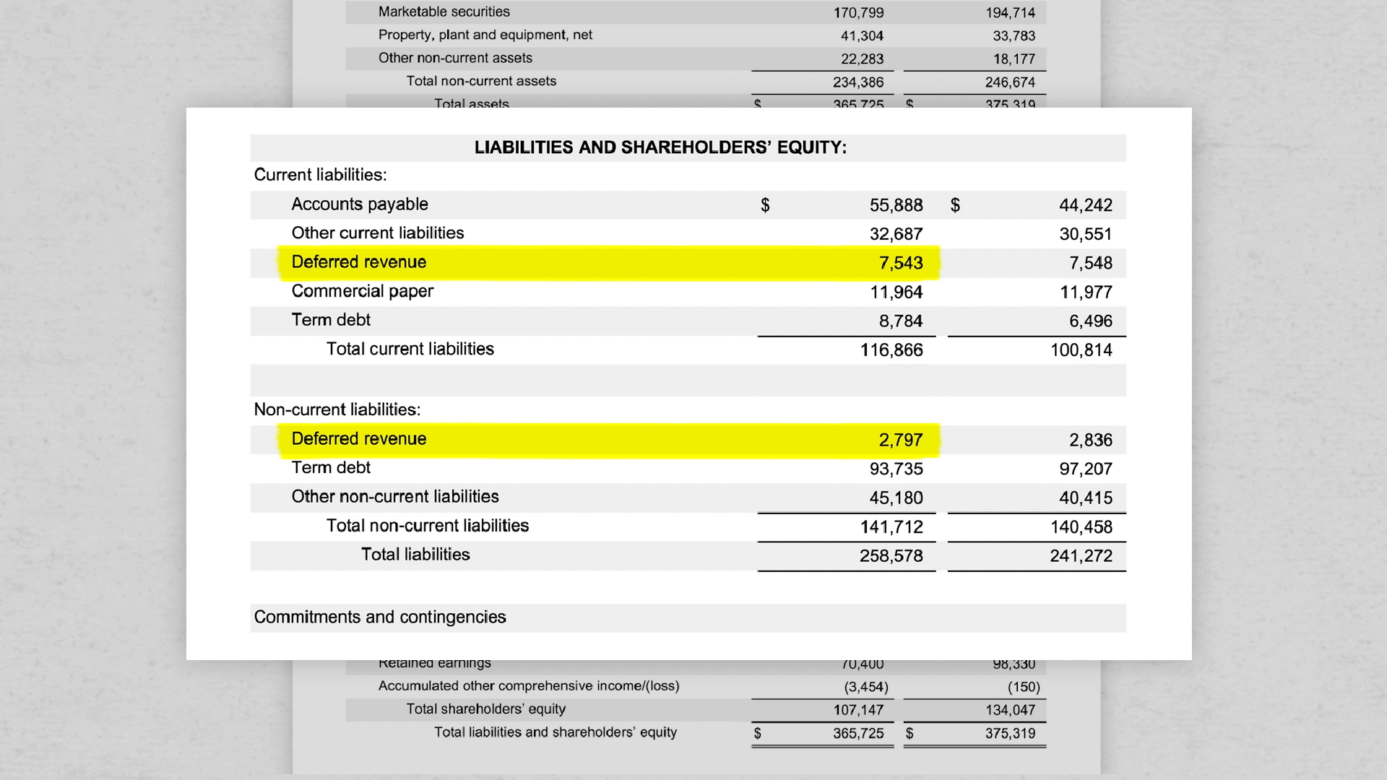

Once the company receives payment, deferred revenue is recorded as a liability on a company’s balance sheet. By recording it as a liability on the balance sheet, the company understands that the revenue represents an outstanding product or service that is owed to the client. Deferred revenue may appear on two separate lines—one in the current liabilities section, and one in the non-current liabilities section. This distinction differentiates deferred revenue that the company expects to earn in less than a year and in more than a year.

Upon delivery, deferred revenue becomes earned revenue on a company’s income statement. The money received from a client may be claimed as earned revenue in full after completion or in parts over a certain period of time. On the other end of the transaction, a client records the payment as a prepaid expense, or an asset, on their balance sheet, deducting at the same rate that the company claims the funds as earned revenue.

The company has an obligation to deliver the product or service to the client, otherwise the company is liable for any cost that may be owed back to the client. A contract (signed by both parties) will likely govern payments returned to the client. For instance, the contract may specify that the company is entitled to partial payment for partial completion of a product or service.

Deferred revenue and different types of accounting

There are two types of accounting: accrual accounting and cash-basis accounting. The difference between the two depends on how—or rather when—a company recognizes revenue as “earned.”

- Accrual accounting: Revenue is documented when a product or service has been completed or delivered, and therefore earned.

- Cash-basis accounting: Revenue is documented once cash has been exchanged, including advance payments.

Deferred revenue is not applicable in cash-basis accounting because once a payment has been made, it is considered revenue for the company. Deferred revenue is therefore most commonly associated with accrual accounting. But in either type, deferred revenue recognition as earned revenue is considered aggressive accounting if it is done too early because it could overestimate a company’s revenue.

GAAP and deferred revenue

Companies and accountants typically abide by a set of rules and legal practices known as “generally accepted accounting principles,” or GAAP. Although not mandatory for all companies, these accounting standards are required for publicly traded and regulated companies under SEC guidelines; smaller, private businesses may choose to abide by the GAAP to avoid future finance mishaps.

GAAP’s 10 principles are:

- Regularity

- Consistency

- Sincerity

- Permanence of Methods

- Non-Compensation

- Prudence

- Continuity

- Periodicity

- Materiality

- Utmost Good Faith

The principle of prudence (number 6) involves a concept known as accounting conservatism—the idea that a company’s financial statements should err on the side of caution and uncertainty. Differentiating deferred revenue from earned revenue is a key aspect of accounting conservatism, which is in turn part of GAAP.

Example of deferred revenue

Deferred revenue is often used with subscription- or membership-based products or services, as well as any other product or service that would require someone to pay up front for something that would be delivered at a later date. Examples of deferred revenue include rent, gym memberships, magazine or newspaper subscriptions, and prepaid insurance.

If you sign up for your local gym and pay for an annual membership, the gym will recognize the initial payment as deferred revenue. Each month that the gym provides a space for you to exercise, it will deduct a portion of your payment from the deferred revenue on its balance sheet and add it to the income statement as earned revenue. At the end of the year, the full amount will be recorded as earned revenue.

Pareto Labs offers engaging on demand courses in business fundamentals. Built to help you elevate your game at work, our courses distill complex business topics — like how to read financial statements, how to manage people, or even how to value a business — into digestible lessons. No business background required. Our library of 200+ lessons will teach you exactly what you need to know to use it at work tomorrow. Sign up for a free trial today to start watching.