A balance sheet is a financial snapshot of a company’s total assets, liabilities, and shareholders’ equity, as reported on a single day. It offers the ease of seeing a business’s value (and is also referred to as a statement of net worth or a statement of financial position) in a single document.

What is a balance sheet?

A balance sheet is one of the three financial statements that, together, paint a comprehensive picture of a business’s assets, liabilities, profits and losses, and income. The balance sheet shows the company’s total assets, and how they’re financed—through debt or equity.

“The balance sheet is a report that tells us what a business owns and what it owes. Put another way, it shows the total amount of money that’s tied up in a business in various forms at a particular point in time.” —Nic Barnhart, co-founder of Pareto Labs

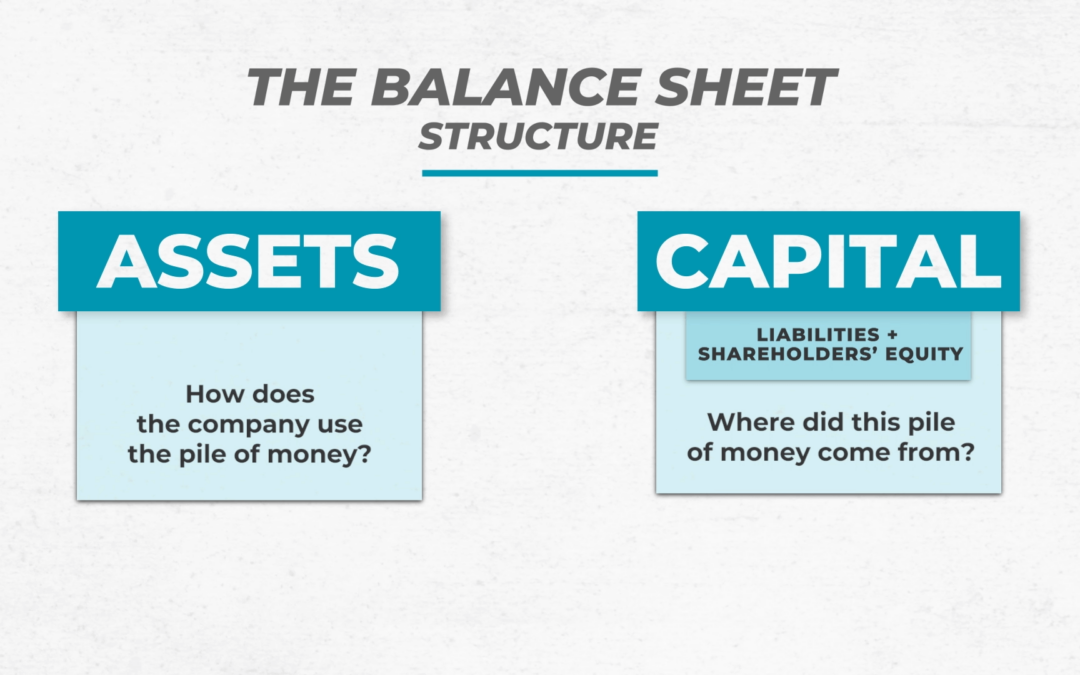

Balance sheets are based on a fundamental formula:

Assets = Liabilities + Equity

In order to see an accurate picture of a company’s total assets, a balance sheet is essentially divided into two sides. One side outlines the company’s assets, the other side shows the company’s liabilities and shareholders’ equity. As its name suggests, balancing the assets against liabilities reflects the company’s liquidity, efficiency, and leverage.

Components of a balance sheet

Assets, liabilities, and shareholders’ equity are the components of a balance sheet.

Assets

Assets are listed in order of their liquidity, and usually from short- to long-term assets:

Short-term assets

- Cash and cash equivalents: Hard currency (dollar bills), Treasury bills and short-term certificates of deposit that can be converted into cash head the liquid cash category for liquidity.

- Marketable securities: These include equity and debt securities that can be easily traded.

- Accounts receivable: The uncollected money owed by customers to the company counts as an asset, although accountants will sometimes include an allowance for accounts that might not be paid.

- Inventory: The company’s goods available for sale, goods that are in the process of being made and raw materials used to make goods the company sells.

- Prepaid expenses: Insurance, contracts, rent, or other expenses the business has already paid go in the assets category.

Long-term assets

- Long-term investments: Any securities that cannot be liquidated within a year fall into this category.

- Fixed assets: These include land, machinery, equipment, vehicles, and buildings.

- Intangible assets: Although this category sounds somewhat difficult to define, it includes non-physical assets that still carry value for the company, such as intellectual property and goodwill.

Liabilities

Liabilities are the money a company owes to suppliers, the portion of rent, utilities, and salaries that are expected to come due, and debt. Like assets, these are usually listed in terms of current and long-term obligations:

Current liabilities are due within one year.

- Current portion of long-term debt: The amount of unpaid principal from long-term debt that accrues in a company’s normal operating cycle.

- Interest payable: The interest expense that has already occurred but hasn’t yet been paid as of the date of the balance sheet.

- Wages payable: Wages earned by but not yet paid to employees.

- Dividends payable: The amount of the after-tax profit a company has authorized to distribute to shareholders but hasn’t yet paid.

- Accounts payable: These are amounts due to suppliers or vendors for goods or services that the company has received but hasn’t yet paid for.

- Earned and unearned premiums: An unearned premium is the amount that corresponds to the time period that remains on an insurance policy (in other words, the policy has not expired, but it appears as a liability because it would have to be paid back upon cancellation). The earned premium is the prorated amount that has been paid in advance to the insurer.

Long-term liabilities (also called non-current liabilities) might include:

- Long-term debt: This debt is the interest and principal on bonds the company has issued that is not due for more than one year.

- Pension-fund liability: Any money a company will be required to pay into its employees’ retirement or pensions.

- Deferred tax liability: These are taxes that have been accrued but won’t be paid for another year.

Shareholders’ equity

Shareholders’ equity, or owners’ equity, appears on a balance sheet as a separate category from assets and liabilities and is the money that can be attributed to a business’s shareholders. Think of it as the total assets of a company less its liabilities (in other words, less the debt it owes to non-shareholders). The net earnings a company either reinvests in the business or uses to pay off debt are retained earnings.

- Common shares: Shares of a company that allow the holder voting rights

- Preferred shares: Shares of a company with dividends that get paid out before common share stockholders

- Retained earnings: Net income not paid out to shareholders at the end of each period

Balance sheet example

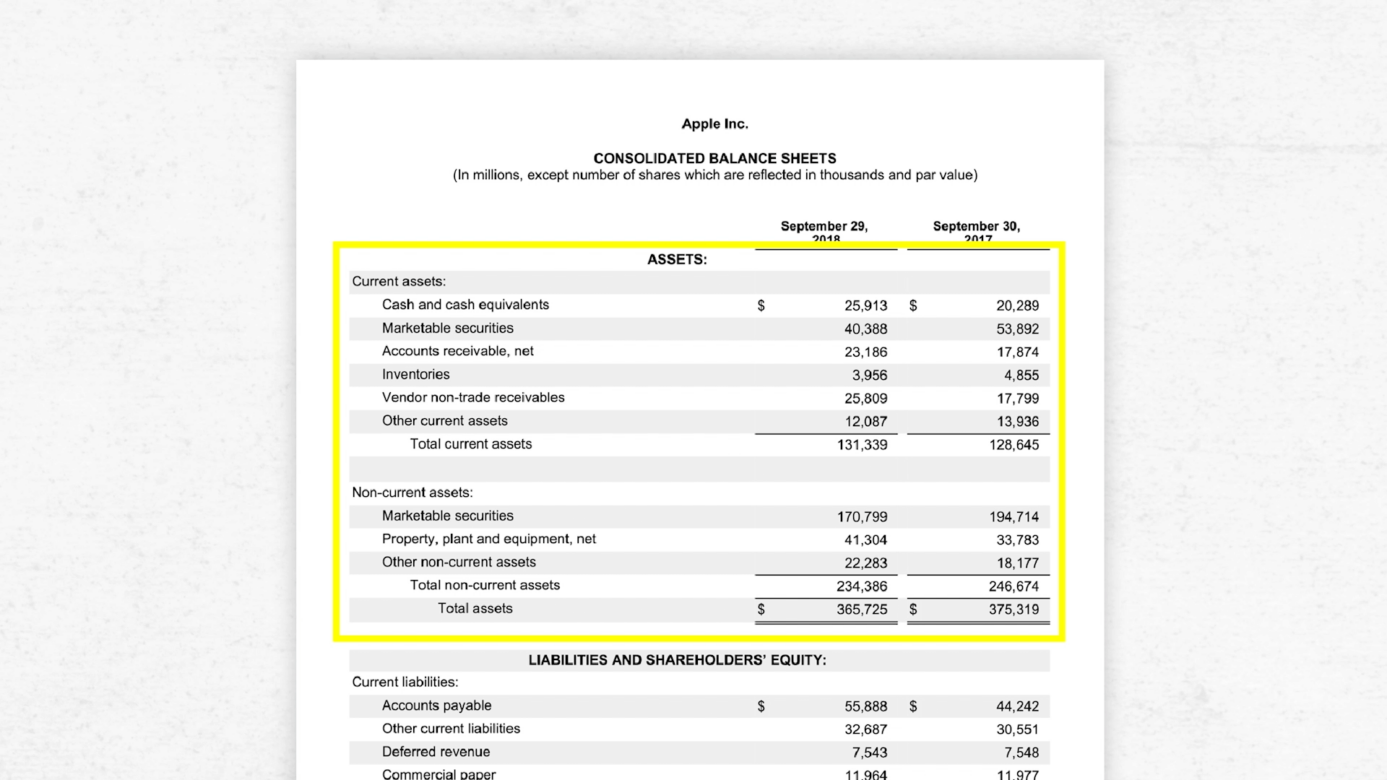

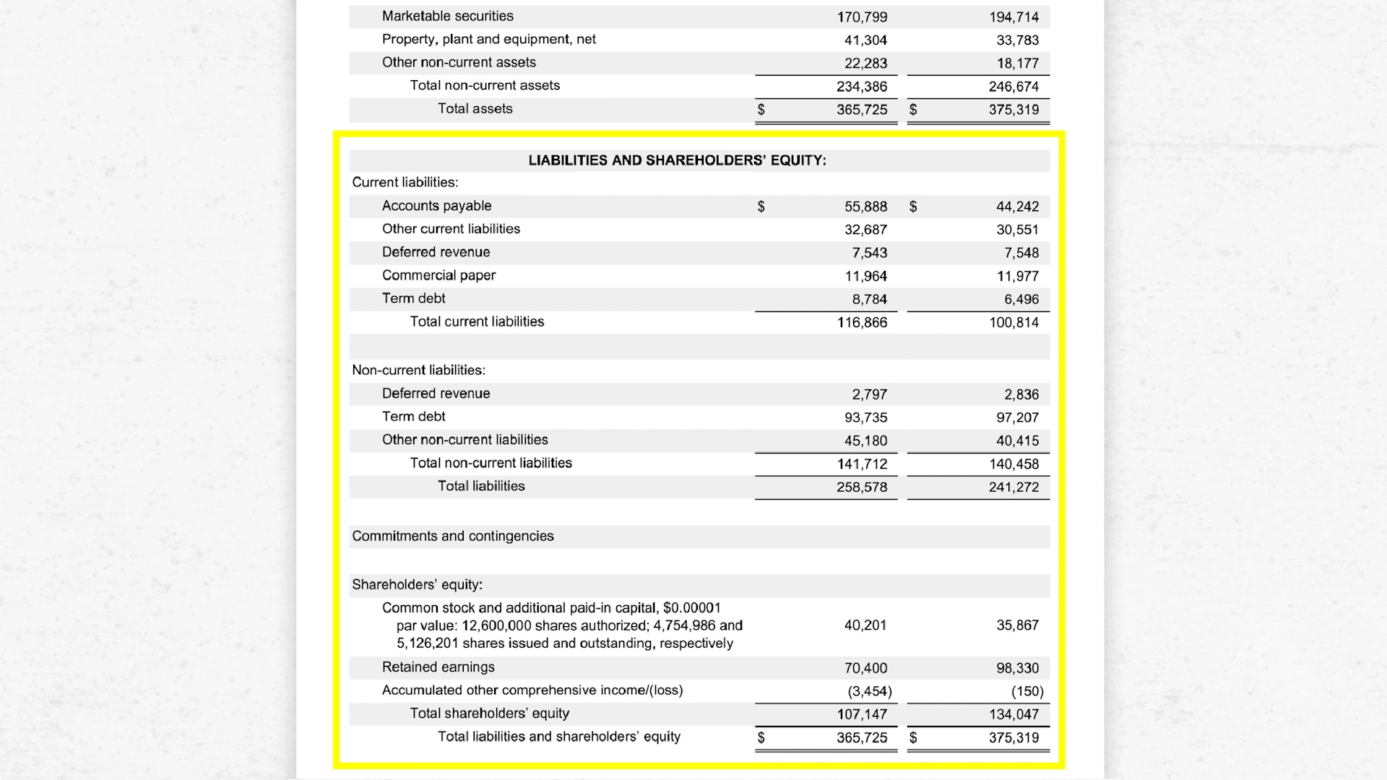

Consider Apple’s balance sheet for the third quarter of 2018. As is specified on the sheet, the numbers presented are in millions, except for the number of shares, which are reflected in thousands and par value.

- Total assets: $365 billion

- Total liabilities: $258 billion

- Total shareholder’s equity: $107 billion

- Total liabilities and shareholder’s equity: $365 billion ($258B + $107B)

What are the other types of financial statements?

Financial statements are periodic reports that can offer you a glimpse into where and how companies make and lose money, as well as their performance and vitality. In addition to balance sheets, there are also:

- Income statement: This document shows a company’s profit and loss over a period of time and is determined by tallying revenues and subtracting expenses from operating and non-operating activities. Its purpose is to reflect profitability.

- Cash flow statement: This document reports the cash that was generated and spent during a segment of time, such as a month, quarter, or year. It reflects the net income of the business.

Together, these three core statements work together to comprehensively reflect a company’s performance. They’re used in concert to create a financial model, which uses the trends in the information in the statements and the trends in historical data to forecast the health of the company and its future performance.

What does a balance sheet tell you about a business?

A balance sheet allows you to calculate financial ratios that show investors and prospective investors the financial health of the company. It can also be compared to balance sheets from previous periods to show trends in the company’s finances.

The debt-to-equity ratio on a company’s balance sheet shows the company’s financial leverage. In other words, it shows how a company is financing its operations through debt versus owned funds. In simple terms, this is calculated by dividing a company’s total liabilities by its shareholder equity. The D/E ratio is crucial, because it shows the ability of shareholder equity to cover outstanding debts in the event of a downturn.

The acid-test ratio, also known as a quick ratio, uses a company’s balance sheet data to show whether it has enough short-term assets to cover short-term liabilities. It doesn’t take into account assets that are difficult to liquidate, like inventory.

What are the limitations of a balance sheet?

A balance sheet is a snapshot of a company at a single moment in time, so it can only tell shareholders and investors the difference between the point in time at which it was calculated at another single point. That is why it is only one part of a company’s financial picture. The income statement and statement of cash flows round out the picture.

Pareto Labs offers engaging on demand courses in business fundamentals. Built to help you elevate your game at work, our courses distill complex business topics — like how to read financial statements, how to manage people, or even how to value a business — into digestible lessons. No business background required. Our library of 200+ lessons will teach you exactly what you need to know to use it at work tomorrow. Sign up for a free trial today to start watching.